Get the free United States Customs Invoice

Show details

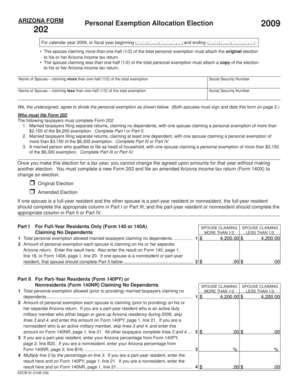

U.S. CUSTOMS INVOICE SHIPPER: CONSIGNEE: EIN# P.O.#/REF#: CARRIER: FROM: PORT OF ENTRY: U.S. BROKER: CUSTOMS CHARGES TO: CURRENCY: NUMBER OF PIECES/WEIGHT: PIECES LBS COUNTRY OF ORIGIN SIGNATURE:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign united states customs invoice

Edit your united states customs invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

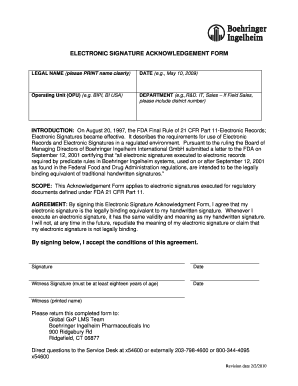

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united states customs invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit united states customs invoice online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit united states customs invoice. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out united states customs invoice

How to Fill Out United States Customs Invoice:

01

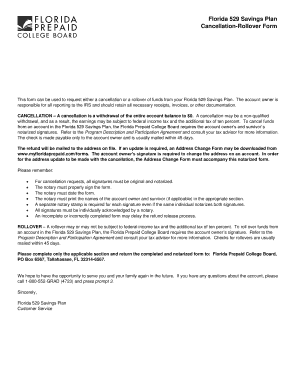

Begin by obtaining a copy of the United States Customs Invoice form. This form can be downloaded from the website of the U.S. Customs and Border Protection agency or obtained from your shipping carrier.

02

Fill in your personal information accurately. This includes your name, address, and contact details. Ensure that this information matches the details on your shipping label or waybill.

03

Provide the recipient's information. Include the recipient's name, address, and contact details. It's essential to double-check this information to ensure accurate delivery.

04

Indicate the shipment details. Specify the nature of the goods being shipped, including a detailed description, quantity, weight, and value. Be as specific as possible to facilitate customs clearance.

05

Include the country of origin. This refers to the country where the goods were manufactured or produced. It is crucial to provide accurate information to comply with customs regulations.

06

Determine the terms of sale. Indicate whether the shipment is a gift, sample, or commercial goods. Each category requires different documentation and may impact customs duties and taxes.

07

Provide the purchase information. This includes the unit value, total value, currency, and payment method. Again, accuracy is paramount to ensure proper customs assessment.

08

Specify the harmonized system (HS) codes for the goods. These codes categorize products for customs purposes. You can consult the Harmonized Tariff Schedule or seek assistance from a customs broker to determine the correct codes.

09

Complete the declaration and sign the form. By signing the United States Customs Invoice, you certify that the information provided is accurate and complete to the best of your knowledge.

Who Needs United States Customs Invoice:

01

Individuals or businesses involved in international shipping to the United States are generally required to complete a United States Customs Invoice. This includes importers and exporters.

02

Companies sending commercial shipments to the United States, regardless of their value, need to include a customs invoice for customs clearance purposes.

03

Individuals sending gifts or personal shipments to the United States may also be required to fill out a customs invoice, depending on the nature and value of the items being shipped.

Note: It's essential to check the specific requirements of the U.S. Customs and Border Protection agency or consult with a customs expert to ensure compliance with all applicable regulations when filling out a United States Customs Invoice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is united states customs invoice?

United States Customs Invoice is a document that provides details about the goods being imported into the United States, including the description, value, and origin.

Who is required to file united states customs invoice?

Importers are required to file United States Customs Invoice when bringing goods into the country.

How to fill out united states customs invoice?

United States Customs Invoice can be filled out manually or electronically through the Automated Commercial Environment (ACE) system.

What is the purpose of united states customs invoice?

The purpose of United States Customs Invoice is to provide customs officials with necessary information about the imported goods for clearance purposes.

What information must be reported on united states customs invoice?

Information such as description of goods, quantity, value, country of origin, and the importer's details must be reported on United States Customs Invoice.

How can I send united states customs invoice for eSignature?

To distribute your united states customs invoice, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit united states customs invoice on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as united states customs invoice. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out united states customs invoice on an Android device?

Complete united states customs invoice and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your united states customs invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

United States Customs Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.