Get the free iht404 - merseysidehouseclearance co

Show details

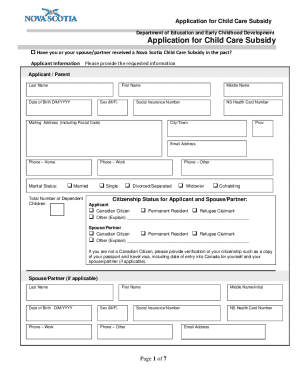

Jointly owned assets Schedule IHT404 When to use this form Name of deceased Fill in this form to give details of any assets that were owned jointly by the deceased and any other person(s). Do not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iht404 - merseysidehouseclearance co

Edit your iht404 - merseysidehouseclearance co form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iht404 - merseysidehouseclearance co form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iht404 - merseysidehouseclearance co online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit iht404 - merseysidehouseclearance co. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iht404 - merseysidehouseclearance co

How to fill out iht404:

01

Gather all necessary information: Before starting to fill out iht404, make sure you have all the required information at hand. This may include details about the deceased person's estate, assets, debts, and beneficiaries.

02

Start with the basic details: Begin by providing the basic information about the deceased person, such as their full name, date of birth, and date of death. These details are essential for accurately identifying the individual.

03

Declare the estate's value: In iht404, you will need to declare the total value of the deceased person's estate. This includes all their assets, such as property, savings, investments, and personal belongings. It is important to accurately assess the value to ensure proper inheritance tax calculations.

04

Deduct any liabilities or debts: If the estate has any outstanding debts or liabilities, they need to be deducted from the total value declared in the previous step. It is important to include all relevant debts, such as mortgages, loans, and unpaid bills, to get an accurate picture of the estate's net value.

05

Identify the beneficiaries: List all the beneficiaries who are entitled to receive a share of the deceased person's estate. Include their full names, relationship to the deceased, and their respective shares or entitlements.

06

Calculate the inheritance tax: Once you have gathered all the necessary information, you can calculate the inheritance tax owed on the estate. This may require consulting the relevant tax regulations or seeking professional advice.

07

Complete the relevant sections: Fill out the iht404 form by entering the required information in the corresponding sections. Make sure to double-check all the provided details for accuracy and completeness.

Who needs iht404:

01

Executors of an estate: The primary individuals who need iht404 are the executors or personal representatives of the deceased person's estate. They are responsible for managing the deceased person's affairs, including the filing of inheritance tax forms.

02

Individuals subject to inheritance tax: Inheritance tax is levied on estates above a certain threshold. If the value of the estate exceeds the applicable threshold, the executors need to fill out iht404 and submit it to the relevant tax authorities.

03

Legal or financial professionals: Lawyers, solicitors, or financial advisors who are assisting the executors in managing the estate may also need to be familiar with iht404 and its completion process. They can provide guidance and ensure compliance with tax regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find iht404 - merseysidehouseclearance co?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific iht404 - merseysidehouseclearance co and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit iht404 - merseysidehouseclearance co on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing iht404 - merseysidehouseclearance co.

How do I edit iht404 - merseysidehouseclearance co on an iOS device?

Use the pdfFiller mobile app to create, edit, and share iht404 - merseysidehouseclearance co from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is iht404?

IHT404 is the form used in the United Kingdom to report inheritance tax.

Who is required to file iht404?

The executor of the deceased's estate or the administrator of the estate is required to file iht404.

How to fill out iht404?

IHT404 can be filled out online or on paper. It requires information about the deceased's estate, including assets and liabilities.

What is the purpose of iht404?

The purpose of iht404 is to calculate and report any inheritance tax due on the deceased's estate.

What information must be reported on iht404?

Information such as the value of the deceased's estate, any gifts made by the deceased in the seven years before their death, and any liabilities must be reported on iht404.

Fill out your iht404 - merseysidehouseclearance co online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

iht404 - Merseysidehouseclearance Co is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.