Get the free CAR LOANS

Show details

2.1.20 Revision Date September 16, 2003, Committee Administration and Finance Committee Source Administration and Finance Committee CAR LOANS 1. A Car Loan may be granted to a clergy person licensed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign car loans

Edit your car loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your car loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing car loans online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit car loans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

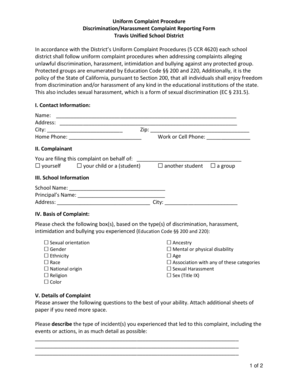

How to fill out car loans

How to fill out car loans:

01

Research different lenders: Begin by researching and comparing different lenders in order to find the one that offers the best interest rates and terms for your car loan. This can be done online or by visiting different financial institutions.

02

Determine your budget: Before applying for a car loan, it is important to assess your finances and determine how much you can afford to spend on monthly payments. Consider factors such as your income, expenses, and other financial obligations to establish a budget that is realistic for you.

03

Gather necessary documents: To fill out a car loan application, you will typically need certain documents such as identification, proof of income, proof of address, and details about the vehicle you intend to purchase. Gather these documents beforehand to streamline the application process.

04

Fill out the application: Once you have chosen a lender and gathered the necessary documents, it is time to fill out the car loan application. Provide accurate and complete information, ensuring that you carefully read all terms and conditions before signing the application.

05

Review loan offers: Once you have submitted your application, lenders will review it and provide loan offers based on your financial profile. Take the time to carefully review these offers, considering factors such as interest rates, loan duration, and any additional fees or charges.

06

Choose the best loan offer: Compare the loan offers you have received and choose the one that best suits your needs and financial capabilities. Consider factors such as the total cost of the loan, monthly payments, and any additional benefits or features offered by the lender.

07

Complete the loan process: After selecting a loan offer, the lender will guide you through the remaining steps to complete the car loan process. This may include providing additional documentation, signing loan agreements, and finalizing the purchase of the vehicle.

Who needs car loans:

01

Individuals without sufficient savings: Car loans are commonly used by individuals who do not have enough savings to purchase a vehicle outright. They allow people to spread the cost of the car over a period of time, making it more affordable and manageable.

02

First-time car buyers: First-time car buyers often need car loans as they may not have the necessary funds to purchase a vehicle outright. Car loans provide an opportunity for these individuals to finance their first car purchase and establish a credit history.

03

Individuals with a low credit score: People with a low credit score may struggle to secure traditional financing options. Car loans, however, are often more accessible to individuals with less-than-perfect credit, providing them with an opportunity to purchase a vehicle and improve their credit profile.

04

Business owners or self-employed individuals: Car loans are also utilized by business owners or self-employed individuals who need a vehicle for professional purposes. They can use car loans to purchase or lease a vehicle for business use, potentially benefiting from tax deductions or write-offs.

05

Individuals looking to improve their credit: Taking out a car loan and making consistent, on-time payments can help individuals build or improve their credit score. This is particularly advantageous for those who have a limited credit history or have previously experienced financial challenges.

It is important to note that the decision to take out a car loan should be based on individual financial circumstances and considerations. It is advisable to carefully assess your financial situation and consult with a financial advisor if needed before applying for any loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find car loans?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific car loans and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit car loans on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing car loans right away.

How do I complete car loans on an Android device?

Use the pdfFiller Android app to finish your car loans and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is car loans?

Car loans are a type of financing provided by financial institutions to help individuals purchase a vehicle.

Who is required to file car loans?

Individuals who are seeking financing to purchase a car are required to file for car loans.

How to fill out car loans?

To fill out car loans, individuals need to provide their personal and financial information, the details of the vehicle they wish to purchase, and agree to the terms of the loan.

What is the purpose of car loans?

The purpose of car loans is to help individuals purchase a vehicle without having to pay the full amount upfront.

What information must be reported on car loans?

Information such as personal details, financial information, details of the vehicle being purchased, and loan terms must be reported on car loans.

Fill out your car loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Car Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.