Get the free Consumer Credit Limit Increase Form - UFAcom

Show details

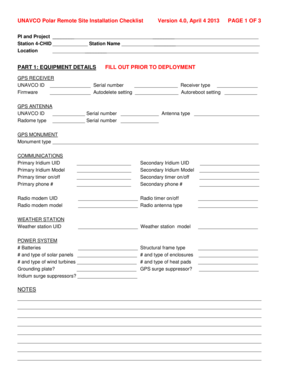

CR01B Consumer Credit Limit Increase Request Form UFA Credit on Account Program About Your Account Number: Current Credit Limit: Requested Credit Limit: Reason for Increase: Consumer Information Member

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit limit increase

Edit your consumer credit limit increase form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit limit increase form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer credit limit increase online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer credit limit increase. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer credit limit increase

How to fill out a consumer credit limit increase:

01

Contact your credit card provider or lender: Start the process by reaching out to your credit card provider or lender. You can typically find their contact information on your credit card statement or their website.

02

Request a credit limit increase: Once you're in touch with your credit card provider, let them know that you're interested in increasing your credit limit. They may ask you for some personal and financial information to evaluate your eligibility.

03

Provide necessary documentation: Depending on the lender's requirements, you may need to submit certain documents to support your request. This might include recent pay stubs, tax returns, or bank statements to demonstrate your income and financial stability.

04

Explain your reasons: It can be helpful to provide a brief explanation of why you're seeking a credit limit increase. Are you planning a large purchase, managing unexpected expenses, or looking to improve your credit utilization ratio? Sharing your intentions can give your lender a better understanding of your needs.

05

Wait for a response: After submitting your request and documentation, you'll need to be patient and allow the credit card provider to review your application. They may take some time to assess your financial situation and make a decision.

06

Review the decision: Once you receive a response from your credit card provider, carefully review their decision. They may approve your request and notify you of the new credit limit, or they may reject it and provide reasons for their decision.

07

Follow up if necessary: If your credit limit increase is denied, you have the option to reach out to your credit card provider and inquire about the reasons. They may provide insights or suggest steps you can take to increase your chances in the future.

Who needs a consumer credit limit increase?

01

Individuals planning a large purchase: If you're considering making a significant purchase, such as buying a home appliance or booking a vacation, having a higher credit limit can provide you with more financial flexibility and make the transaction smoother.

02

Those managing unexpected expenses: Life is full of surprises, and sometimes unexpected expenses can arise, such as medical bills or home repairs. A higher credit limit can help you cover these unforeseen costs without disrupting your finances or overdrawing your account.

03

Individuals aiming to improve their credit utilization ratio: Your credit utilization ratio is a crucial factor in determining your credit score. By increasing your credit limit, you can potentially lower your ratio, which can positively impact your creditworthiness and improve your overall credit score.

Remember, while a credit limit increase can be beneficial in certain situations, it's essential to use credit responsibly and avoid excessive debt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer credit limit increase for eSignature?

Once you are ready to share your consumer credit limit increase, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the consumer credit limit increase form on my smartphone?

Use the pdfFiller mobile app to fill out and sign consumer credit limit increase. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit consumer credit limit increase on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share consumer credit limit increase from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is consumer credit limit increase?

Consumer credit limit increase refers to the process of raising the maximum amount of credit that a consumer is allowed to borrow from a lender.

Who is required to file consumer credit limit increase?

Consumers who wish to increase their credit limit are required to submit a request to their credit card issuer or lender.

How to fill out consumer credit limit increase?

To fill out a consumer credit limit increase request, consumers typically need to provide information such as their current credit limit, income, and reasons for requesting the increase.

What is the purpose of consumer credit limit increase?

The purpose of a consumer credit limit increase is to give consumers more flexibility in their borrowing ability and provide access to additional funds when needed.

What information must be reported on consumer credit limit increase?

Consumers may be required to report their current credit limit, income, employment status, and reasons for requesting the increase.

Fill out your consumer credit limit increase online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit Limit Increase is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.