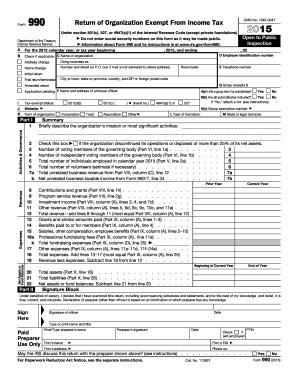

IL Home Rule Tax Registration Application 2015-2025 free printable template

Show details

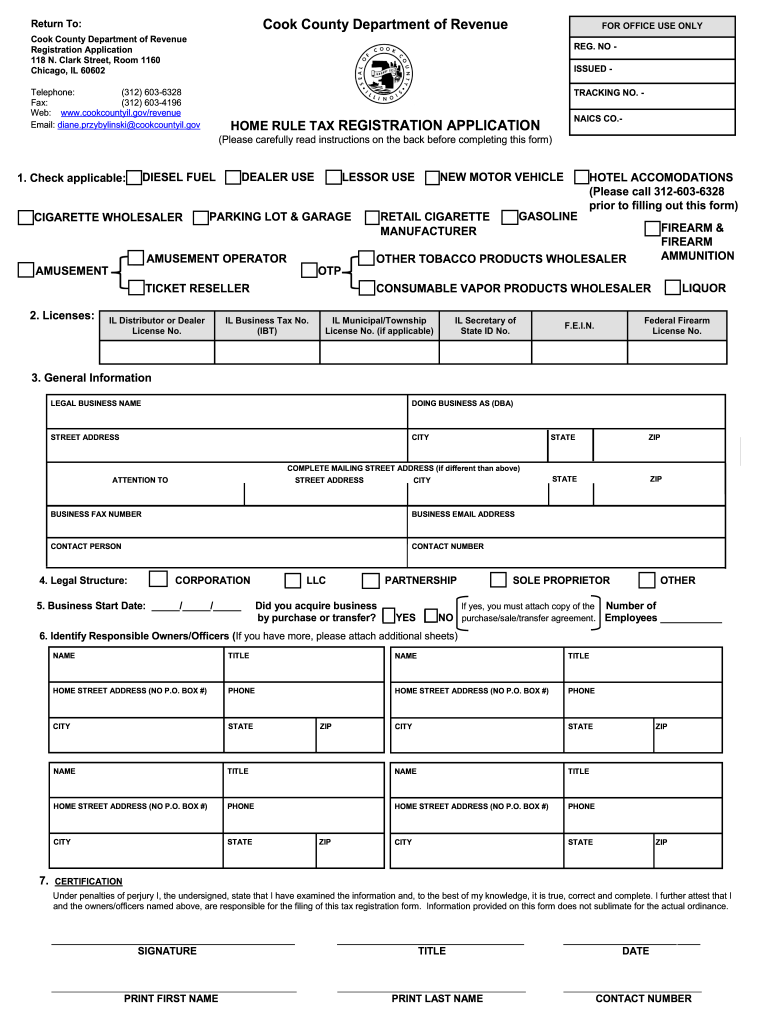

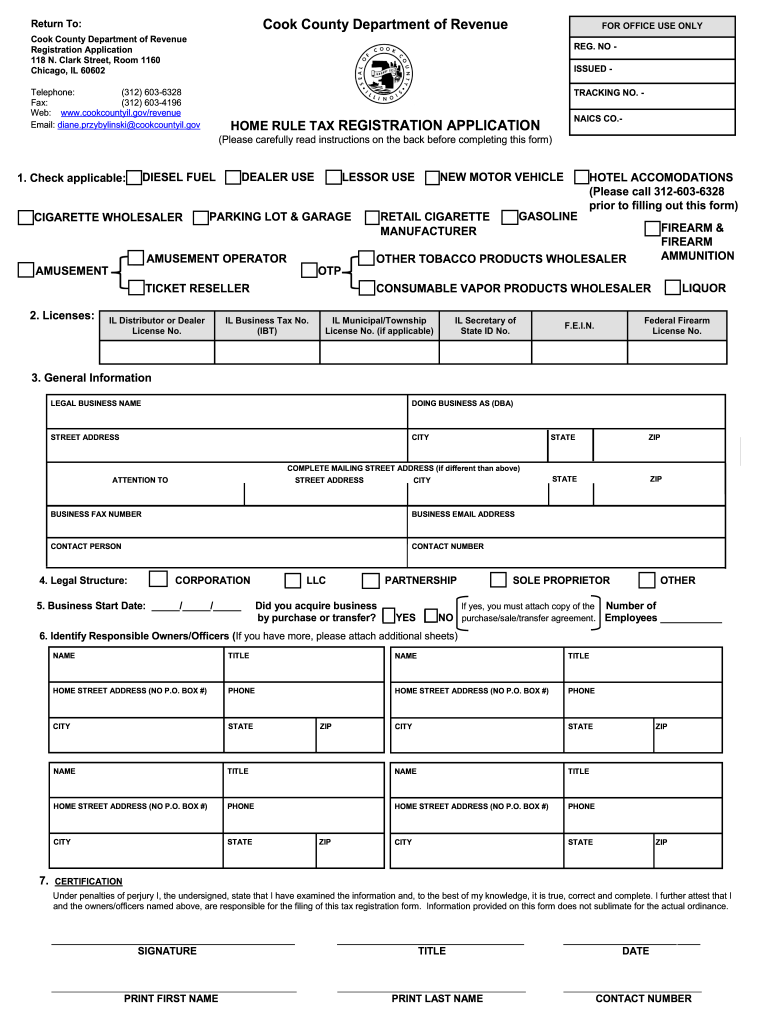

Cook County Department of Revenue Return To: FOR OFFICE USE ONLY Cook County Department of Revenue Registration Application 118 N. Clark Street, Room 1160 Chicago, IL 60602 REG. NO ISSUED Telephone:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL Home Rule Tax Registration Application

Edit your IL Home Rule Tax Registration Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL Home Rule Tax Registration Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL Home Rule Tax Registration Application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL Home Rule Tax Registration Application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IL Home Rule Tax Registration Application

How to fill out IL Home Rule Tax Registration Application

01

Obtain the IL Home Rule Tax Registration Application form from the Illinois Department of Revenue website or a local government office.

02

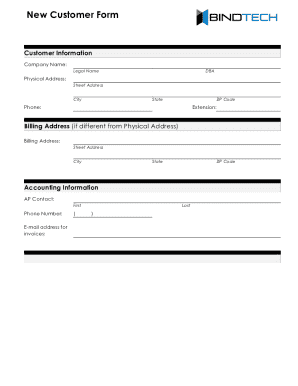

Complete the form by providing your business name, address, and federal employer identification number (EIN).

03

Indicate the type of business you operate and select the specific home rule tax(es) you are registering for.

04

Fill in the dates your business started and when you plan to begin collecting the home rule tax.

05

Provide information about your business ownership structure, including the names of owners or partners and their contact information.

06

Review all provided information for accuracy and completeness.

07

Sign and date the application form to certify that the information is correct.

08

Submit the completed application form to the appropriate local government or taxing authority.

Who needs IL Home Rule Tax Registration Application?

01

Any business that operates in a home rule municipality in Illinois and is required to collect local taxes.

02

Businesses that intend to engage in activities that are subject to home rule taxes such as sales tax or other local taxes.

03

New business owners starting operations in a home rule municipality.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax in Illinois?

Illinois also has a 9.50 percent corporate income tax rate. Illinois has a 6.25 percent state sales tax rate, a 4.75 percent max local sales tax rate, and an average combined state and local sales tax rate of 8.82 percent. Illinois's tax system ranks 36th overall on our 2023 State Business Tax Climate Index.

Is Illinois tax rate high?

Illinois residents face an effective total state and local tax rate of over 15%, the nation's highest, based on the median U.S. household income. Effective tax rate, total taxes, U.S. rank by state.

What is Chicago tax?

What is the sales tax rate in Chicago, Illinois? The minimum combined 2023 sales tax rate for Chicago, Illinois is 10.25%. This is the total of state, county and city sales tax rates.

What states have no state income tax?

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

What is the sales tax of Illinois?

The Illinois' general state sales and use tax rates are: 6.25 percent on general merchandise, including items required to be titled or registered by an agency of Illinois state government; and. 1 percent on qualifying foods, drugs, and medical appliances.

Which state has the highest sales tax?

States with the highest sales tax California: 7.25% sales tax rate. Indiana: 7% sales tax rate. Mississippi: 7% sales tax rate. Rhode Island 7% sales tax rate. Tennessee: 7% sales tax rate. Minnesota: 6.875% sales tax rate. Nevada: 6.85% sales tax rate. New Jersey: 6.625% sales tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IL Home Rule Tax Registration Application in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IL Home Rule Tax Registration Application and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find IL Home Rule Tax Registration Application?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the IL Home Rule Tax Registration Application. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the IL Home Rule Tax Registration Application in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is IL Home Rule Tax Registration Application?

The IL Home Rule Tax Registration Application is a form used by businesses to register for local taxes imposed by home rule municipalities in Illinois.

Who is required to file IL Home Rule Tax Registration Application?

Any business operating within a home rule municipality that imposes its own taxes must file the IL Home Rule Tax Registration Application.

How to fill out IL Home Rule Tax Registration Application?

To fill out the application, you must provide your business information, including name, address, and type of business, as well as details about the taxes you are registering for.

What is the purpose of IL Home Rule Tax Registration Application?

The purpose of the application is to ensure that businesses comply with local tax regulations and to aid municipalities in collecting the appropriate taxes.

What information must be reported on IL Home Rule Tax Registration Application?

The application requires information such as the business name, business address, owner information, type of tax being registered for, and any other pertinent details related to tax compliance.

Fill out your IL Home Rule Tax Registration Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL Home Rule Tax Registration Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.