Get the free 1: Personal Budget Form MONTHLY BREAKDOWN OF EXPENSES: Category Plan 1 Monthly amoun...

Show details

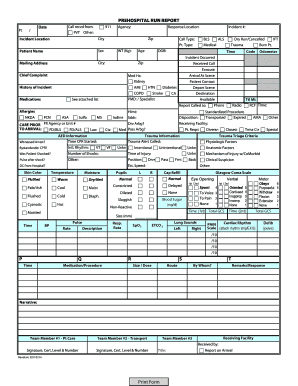

Worksheet 1.1: Personal Budget Form MONTHLY BREAKDOWN OF EXPENSES: Category Plan 1 Monthly amount Plan 2 Monthly amount Housing (rent, utilities) Bills (phone, Internet, cable, gas, electricity) Food

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1 personal budget form

Edit your 1 personal budget form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 personal budget form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1 personal budget form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1 personal budget form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1 personal budget form

How to fill out 1 personal budget form:

01

Start by gathering all relevant financial documents, including income statements, expense receipts, and bank statements.

02

Begin filling out the personal information section, which may include your name, address, contact information, and social security number.

03

Move on to the income section and provide accurate details about your sources of income, such as your salary, investments, freelance work, or any other sources.

04

In the expense section, list all your monthly expenses such as rent/mortgage payments, utilities, groceries, transportation, insurance, and any other regular bills.

05

Be thorough and include both fixed expenses and variable expenses. Fixed expenses are those that remain the same each month, like rent, while variable expenses fluctuate, such as utility bills.

06

Track your discretionary spending, including entertainment, dining out, and miscellaneous expenses. It is important to track these expenses to get an accurate picture of your budget.

07

Deduct your total expenses from your total income to calculate your monthly savings or deficit. This will give you a clear understanding of how much money you have left after covering your expenses.

08

Review all the information you have provided to ensure accuracy and completeness.

09

Sign and date the form to certify its authenticity.

10

Store a copy of the filled-out personal budget form for your records.

Who needs 1 personal budget form:

01

Individuals who aim to manage their finances more effectively and gain control over their spending habits.

02

People looking to track their income and expenses to create a comprehensive overview of their financial situation.

03

Individuals who want to set financial goals and track their progress towards achieving them.

04

Anyone interested in identifying areas of unnecessary spending and finding opportunities to save money.

05

People who want to create a budget for a specific purpose, such as saving for a down payment, paying off debt, or planning for a significant expense.

06

Individuals who want to evaluate their current financial state and make informed decisions about their financial future.

07

Anyone interested in understanding their cash flow and ensuring their expenses align with their income.

08

People who want to monitor their personal finances and make adjustments as needed to achieve financial stability and success.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1 personal budget form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 1 personal budget form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send 1 personal budget form to be eSigned by others?

When you're ready to share your 1 personal budget form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the 1 personal budget form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 1 personal budget form in minutes.

What is 1 personal budget form?

1 personal budget form is a document used to track income and expenses for an individual or household.

Who is required to file 1 personal budget form?

Any individual or household looking to manage their finances more effectively may choose to file a personal budget form.

How to fill out 1 personal budget form?

To fill out a personal budget form, one needs to list all sources of income and expenses, categorize them, and calculate the total amounts for each category.

What is the purpose of 1 personal budget form?

The purpose of a personal budget form is to help individuals or households track their spending, identify areas where they can save money, and plan for future financial goals.

What information must be reported on 1 personal budget form?

Information such as sources of income, expenses, savings, debt payments, and other financial obligations must be reported on a personal budget form.

Fill out your 1 personal budget form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1 Personal Budget Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.