Get the free Self-Funded Pooled Disability Trust Attorney Checklist

Show details

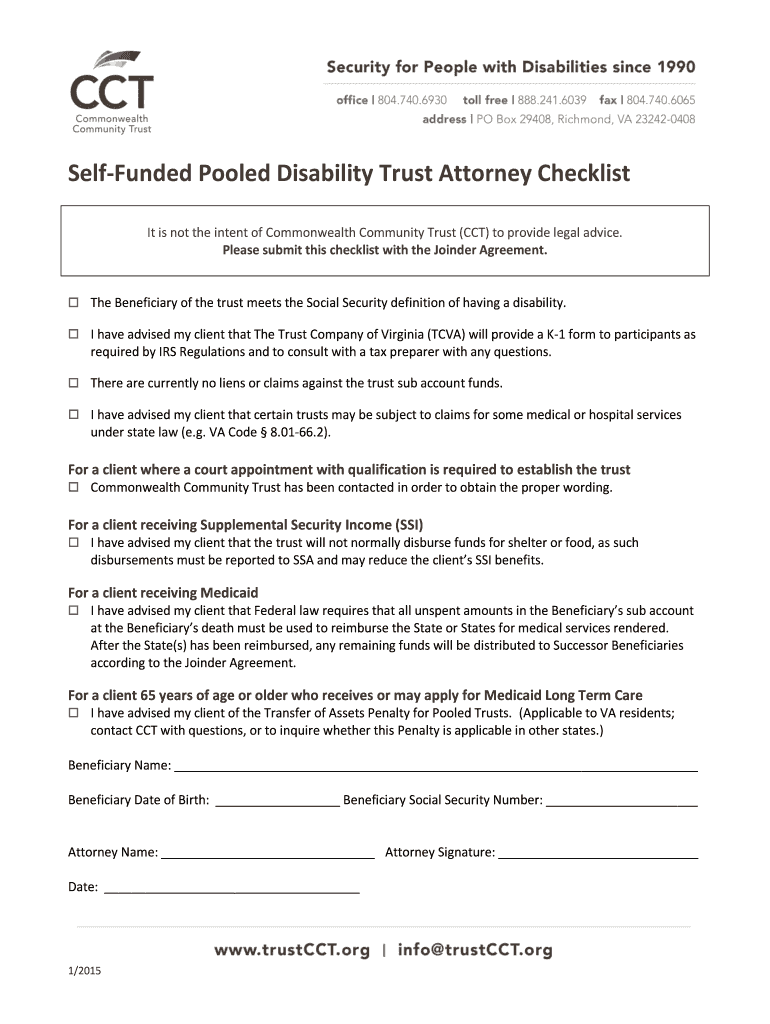

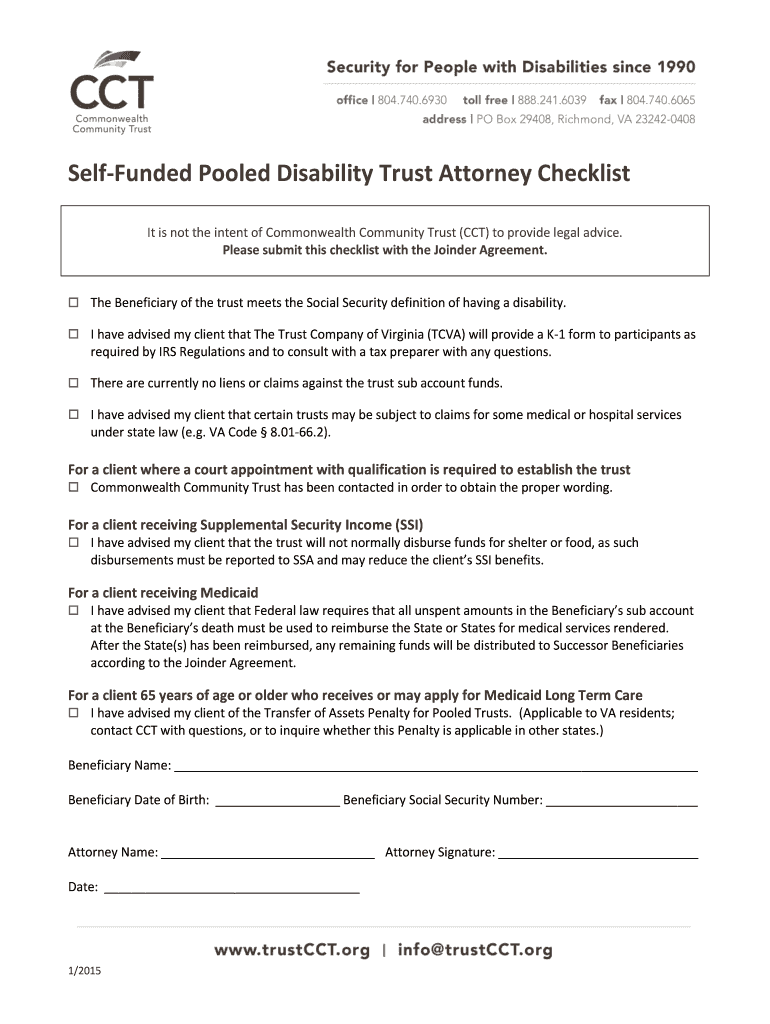

Refunded Pooled Disability Trust Attorney Checklist It is not the intent of Commonwealth Community Trust (CCT) to provide legal advice. Please submit this checklist with the Joiner Agreement. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-funded pooled disability trust

Edit your self-funded pooled disability trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-funded pooled disability trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-funded pooled disability trust online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self-funded pooled disability trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-funded pooled disability trust

How to fill out self-funded pooled disability trust:

01

Gather necessary documentation and information such as your personal identification details, medical reports, and financial records.

02

Contact a professional or an attorney experienced in special needs planning to guide you through the process.

03

Research and choose a qualified pooled trust administrator who can assist you in managing the trust funds and complying with legal requirements.

04

Complete the application forms provided by the pooled trust administrator, providing accurate and detailed information about the beneficiary, their disability, and their financial situation.

05

Consult with an accountant or financial advisor to determine the appropriate funding amount for the trust and to evaluate the impact on government benefits.

06

Review and sign all necessary legal documents, including a trust agreement and a joinder agreement (if applicable).

07

Fund the trust by transferring assets, such as cash, investments, or real estate, to the trust account.

08

Ensure ongoing compliance with reporting requirements and annual tax filings for the trust.

09

Regularly review the trust documents and make any necessary updates in case of changes in circumstances or regulations.

Who needs self-funded pooled disability trust?

01

Individuals with disabilities who rely on government benefits, such as Supplemental Security Income (SSI) or Medicaid, and wish to preserve their eligibility while having additional financial resources.

02

Families or caregivers of individuals with disabilities who want to establish a legal structure to manage and protect the beneficiary's assets.

03

Individuals who anticipate receiving a substantial asset, such as an inheritance or personal injury settlement, and want to ensure their financial stability without losing access to essential benefits.

04

Those who want to plan for the long-term care and support of a loved one with special needs after their own passing.

05

Individuals seeking a professional and experienced trustee to manage their assets, provide accounting, and relieve them from administrative tasks associated with managing a trust.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute self-funded pooled disability trust online?

pdfFiller has made it easy to fill out and sign self-funded pooled disability trust. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my self-funded pooled disability trust in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your self-funded pooled disability trust right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit self-funded pooled disability trust on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share self-funded pooled disability trust from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is self-funded pooled disability trust?

Self-funded pooled disability trust is a special type of trust created to hold funds for the benefit of individuals with disabilities.

Who is required to file self-funded pooled disability trust?

A self-funded pooled disability trust must be filed by the trustee or administrator of the trust.

How to fill out self-funded pooled disability trust?

To fill out a self-funded pooled disability trust, the trustee or administrator must provide detailed information about the trust assets, beneficiaries, and disbursements.

What is the purpose of self-funded pooled disability trust?

The purpose of a self-funded pooled disability trust is to provide financial support and asset protection for individuals with disabilities while preserving their eligibility for government benefits.

What information must be reported on self-funded pooled disability trust?

Information that must be reported on a self-funded pooled disability trust includes details about trust assets, beneficiaries, disbursements, and any changes to the trust document.

Fill out your self-funded pooled disability trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Funded Pooled Disability Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.