SAIF X801 2011 free printable template

Show details

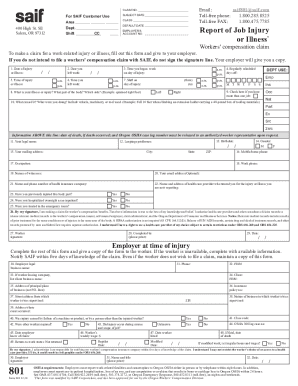

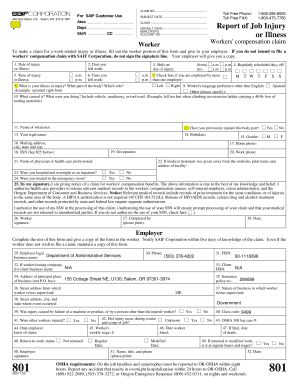

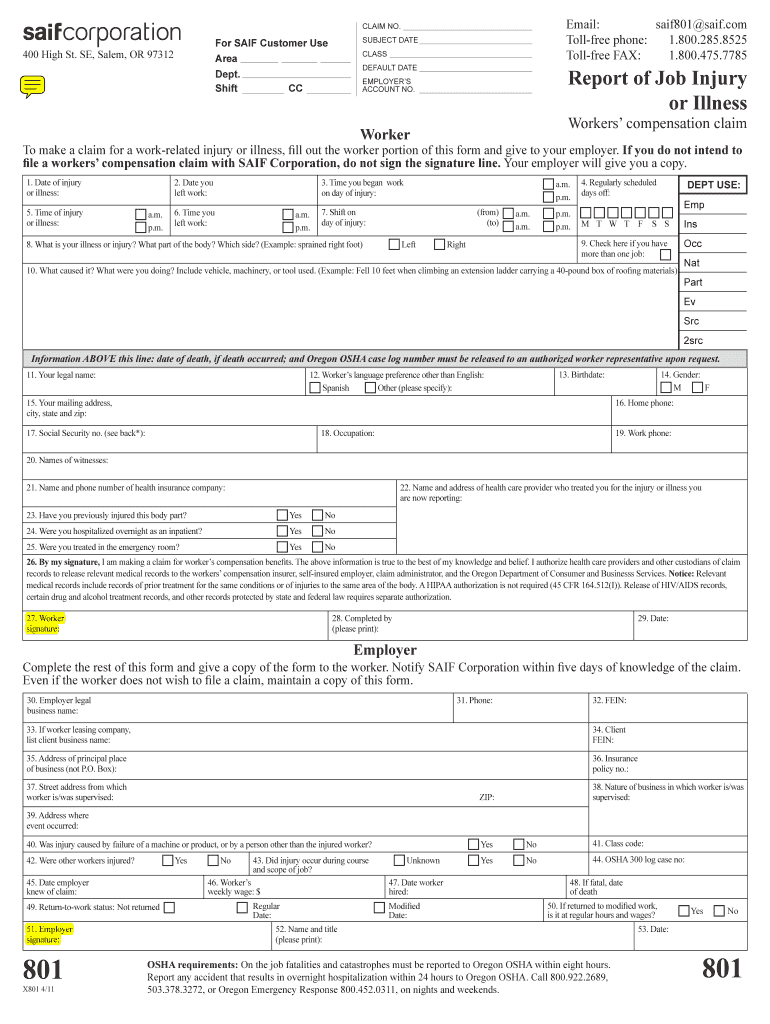

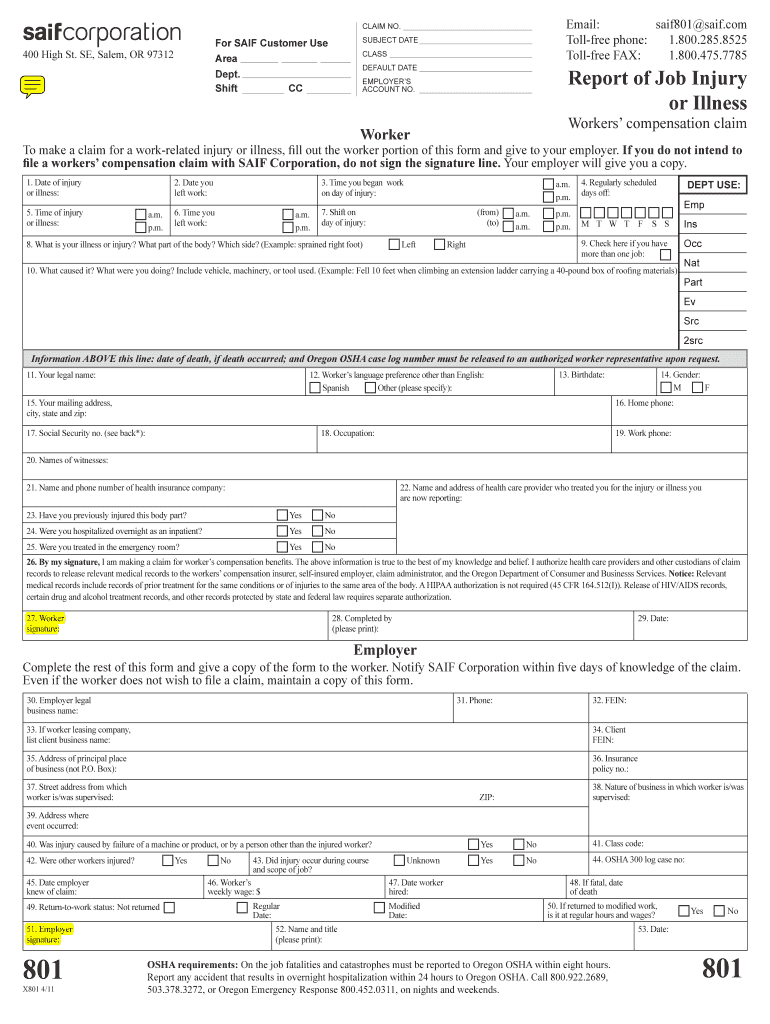

Notify SAIF Corporation within five days of knowledge of the claim. Even if the worker does not wish to file a claim maintain a copy of this form. 30. 800. 285. 8525 1. 800. 475. 7785 Report of Job Injury or Illness EMPLOYER S ACCOUNT NO. Workers compensation claim Worker To make a claim for a work-related injury or illness fill out the worker portion of this form and give to your employer. If you do not intend to file a workers compensation claim with SAIF Corporation do not sign the...

pdfFiller is not affiliated with any government organization

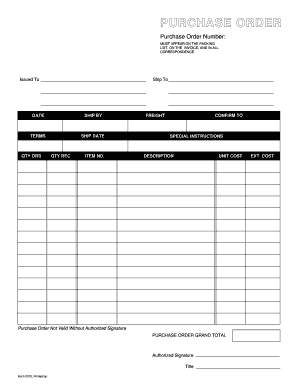

Get, Create, Make and Sign SAIF X801

Edit your SAIF X801 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SAIF X801 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SAIF X801 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SAIF X801. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SAIF X801 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SAIF X801

How to fill out SAIF X801

01

Obtain the SAIF X801 form from the official website or your local office.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the details of your employment history, including previous employers, job titles, and dates of employment.

04

Complete any required sections related to your current employment status and the reason for filing the form.

05

Review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate agency or office as directed.

Who needs SAIF X801?

01

Individuals seeking unemployment benefits or compensation.

02

Employees who have been laid off or separated from their jobs.

03

Workers looking to file a claim for benefits under state-specific labor laws.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to file a workers comp claim in Oregon?

Your employer must send your workers' compensation claim (Form 801) to its insurer within five days of being notified of your injury. It is illegal for employers to do anything to keep employees from filing claims.

What is OSHA 801?

Report of Job Injury or Illness, Workers' Compensation Claim Form 801. Page 1. Worker. Workers' compensation claim. To make a claim for a work-related injury or illness, fill out the worker portion of this form and give to your employer.

What is the form for workers comp claims in Oregon?

Fill out Form 801 “Report of Job Injury or Illness” and turn it in to your employer. Your employer should send it to its workers' compensation insurance carrier within five days of your notice. Your employer should provide you this form.

What is an 801 form Oregon?

To browse FormTitleCategory801Report of Job Injury or IllnessFirst report of injury801sReporte de Lesión o Enfermedad en el TrabajoFirst report of injury

How does workers comp work in Oregon?

Workers' compensation insurance pays benefits if you suffer from an injury or disease in your employment. It pays for medical expenses for your accepted conditions. It provides compensation when you lose time from work. It provides compensation if you suffer a permanent disability.

What is work related illness injury?

The general rule is that all injuries and illnesses which result from events or exposures on the employer's premises are presumed to be work related. Furthermore, if it seems likely that an event or exposure in the work environment either caused or contributed to the case, the case is considered work related.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find SAIF X801?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the SAIF X801. Open it immediately and start altering it with sophisticated capabilities.

How can I edit SAIF X801 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing SAIF X801.

How do I fill out the SAIF X801 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign SAIF X801 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is SAIF X801?

SAIF X801 is a reporting form used for tax and financial compliance, often related to certain types of income or business activity in specific jurisdictions.

Who is required to file SAIF X801?

Individuals or entities that meet specific criteria for reporting income, tax liabilities, or business activities as mandated by the relevant tax authority are required to file SAIF X801.

How to fill out SAIF X801?

To fill out SAIF X801, taxpayers should gather all necessary financial information, carefully follow the instructions provided with the form, and ensure all required sections are completed accurately.

What is the purpose of SAIF X801?

The purpose of SAIF X801 is to provide the tax authority with necessary information to assess tax liability, ensure compliance, and collect accurate data regarding income and business operations.

What information must be reported on SAIF X801?

The information reported on SAIF X801 typically includes details about income earned, expenses incurred, business activities, and any other financial data required by the tax authority.

Fill out your SAIF X801 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SAIF x801 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.