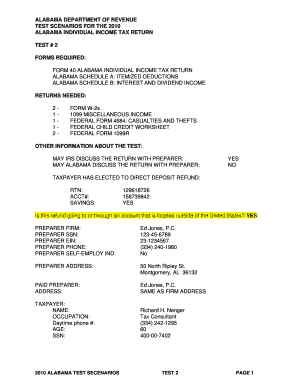

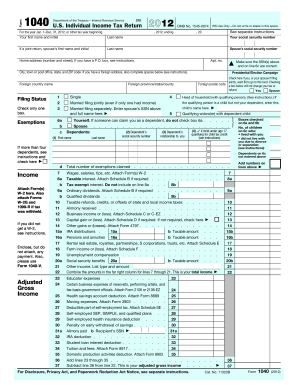

1040 Form 2012 - Page 7

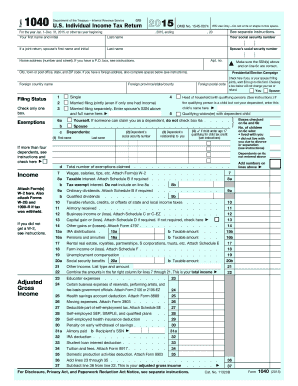

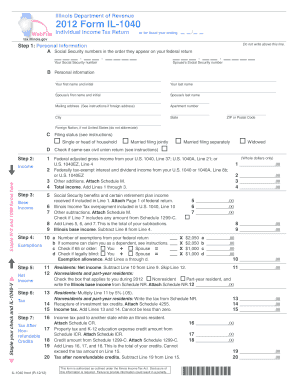

What is 1040 Form 2012?

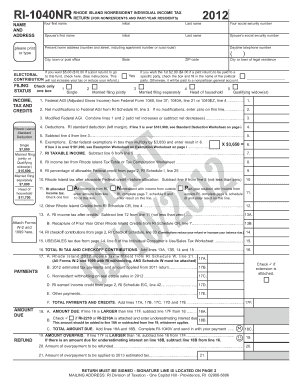

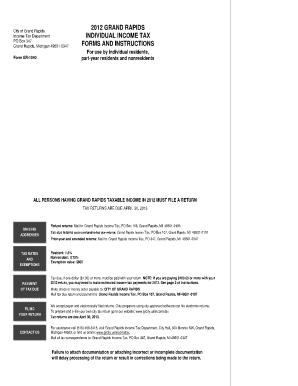

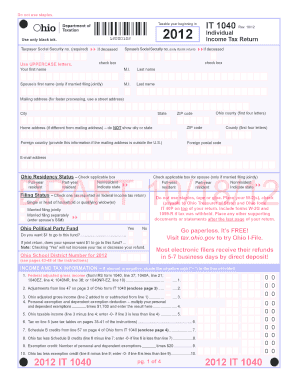

1040 Form 2012 is an official document used by individuals to report their annual income and calculate their tax liabilities for the year 2012. It is used by taxpayers in the United States to file their federal income tax returns. This form is provided by the Internal Revenue Service (IRS) and is an essential requirement for every taxpayer to fulfill their tax obligations.

What are the types of 1040 Form 2012?

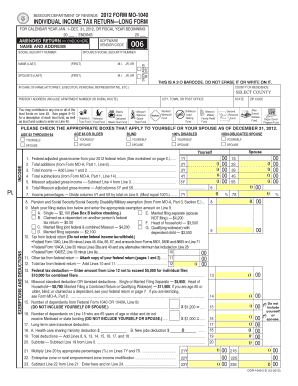

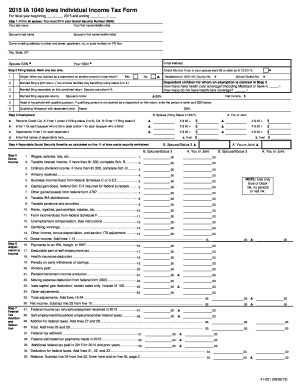

There are three main types of 1040 Form 2012:

1040 - The standard form used by most taxpayers to report their income and deductions.

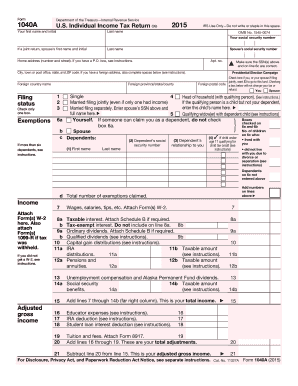

1040A - A simplified version of the 1040 form for taxpayers with less complex tax situations.

1040EZ - The simplest version of the form, designed for taxpayers with very basic tax situations and no dependents.

How to complete 1040 Form 2012

To complete 1040 Form 2012, follow these steps:

01

Gather all necessary documents and information, including W-2 forms, 1099 forms, and records of deductions.

02

Fill in your personal information, such as your name, address, and social security number.

03

Report your income and calculate your adjusted gross income (AGI).

04

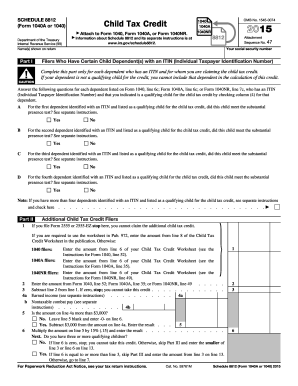

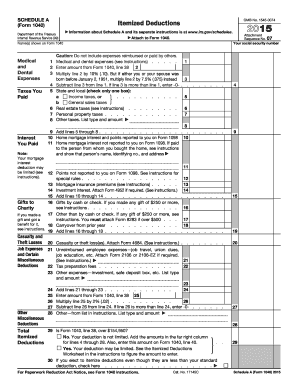

Determine your deductions and exemptions.

05

Calculate your tax liability and any refund or additional tax owed.

06

Sign and date the form.

07

Attach any necessary schedules or supporting documents.

08

Mail the completed form to the appropriate IRS address or file it electronically.

pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effectively.

Video Tutorial How to Fill Out 1040 Form 2012

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I download old tax forms?

The only way you can obtain copies of your tax return from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.

Is it possible to file old tax returns?

Individuals can file returns for the previous years. This can only be done for the two years preceding the current financial year for which the returns have to be filed. Taxpayers are provided a two year period during which returns can be filed.

How do I get my tax forms from previous years?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

Can I still file my 2012 tax return?

Note: If filing for a tax refund the time to file a 2012 tax return has expired. To file a 2012 tax return for a tax refund had to be filed on or before April 15, 2016.

Where can I find all my tax documents?

Get a Transcript of a Tax Return Online - To read, print, or download your transcript online, you'll need to register at IRS.gov. To sign-up, create an account with a username and a password. By mail - To get a transcript delivered by postal mail, submit your request online.

How do I get my last year's 1040?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.