1098 T Online

What is 1098 t online?

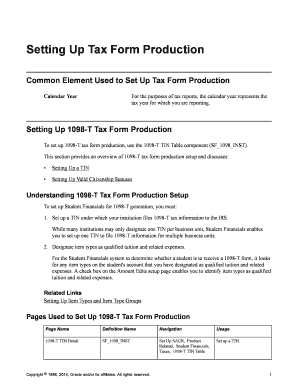

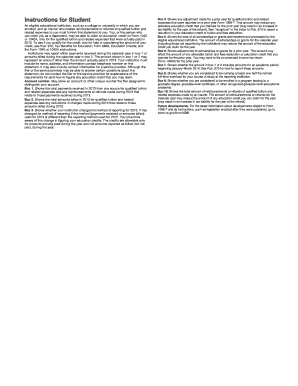

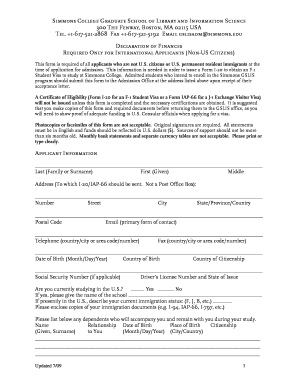

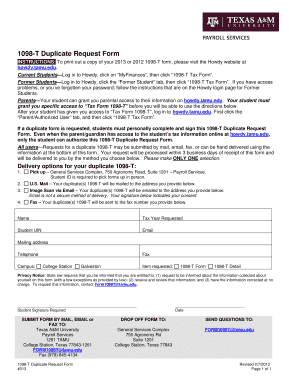

The 1098 t online is an electronic form provided by educational institutions to students in the United States. It is used to report information about qualified tuition and related expenses that may be eligible for tax credits or deductions. By receiving the 1098 t online, students can easily access and review important information regarding their educational expenses for tax purposes.

What are the types of 1098 t online?

There are two main types of 1098 t forms that can be accessed online:

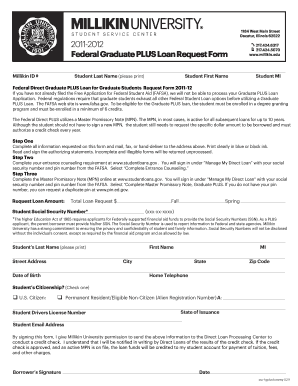

How to complete 1098 t online

Completing the 1098 t online is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.