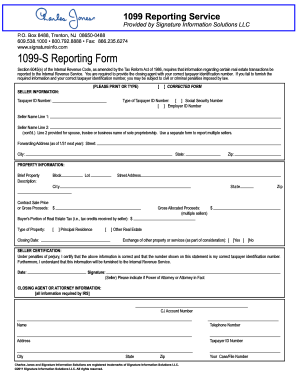

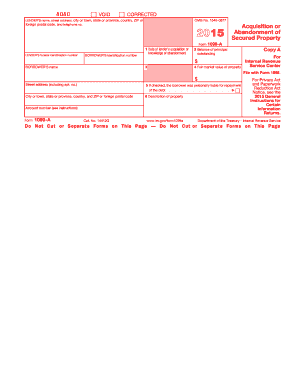

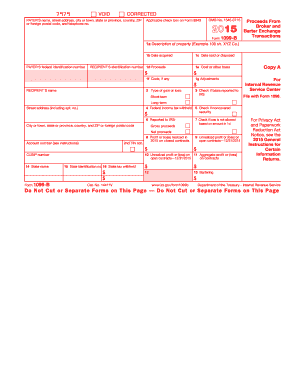

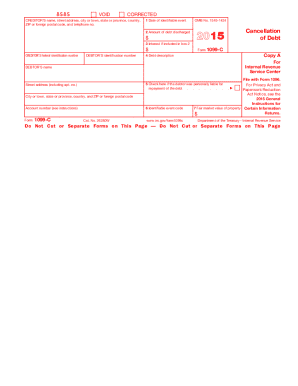

1099 Form

What is 1099 Form?

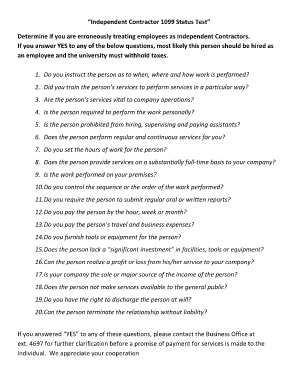

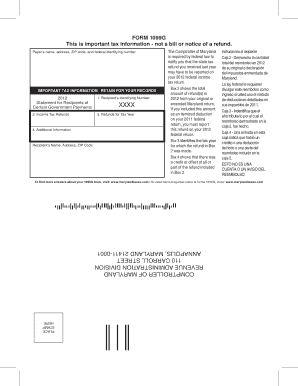

The 1099 Form is a tax form used by businesses to report income paid to individuals or entities who are not employees. This form is used to report several types of payments, including rental income, interest income, dividend income, and self-employment income.

What are the types of 1099 Form?

There are several types of 1099 Forms, each corresponding to a specific type of income. Some common types of 1099 Forms include: 1. 1099-MISC: Used to report miscellaneous income, such as freelance work or compensation for services. 2. 1099-INT: Used to report interest income. 3. 1099-DIV: Used to report dividend income. 4. 1099-NEC: Used to report nonemployee compensation. 5. 1099-R: Used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and more.

How to complete 1099 Form

Completing the 1099 Form is a straightforward process. Follow these steps to ensure accurate and timely completion:

By following these steps, you can easily complete the 1099 Form and fulfill your tax reporting obligations.