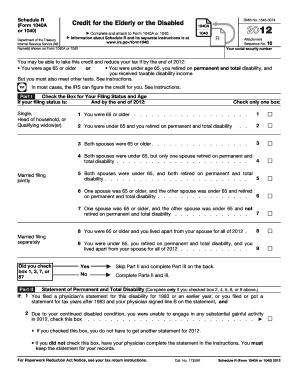

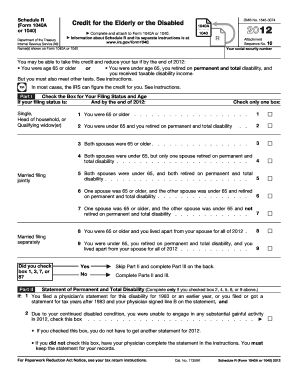

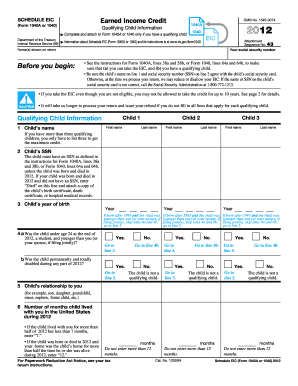

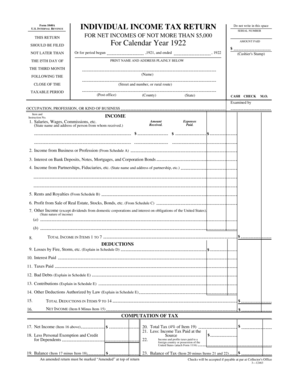

2012 1040a

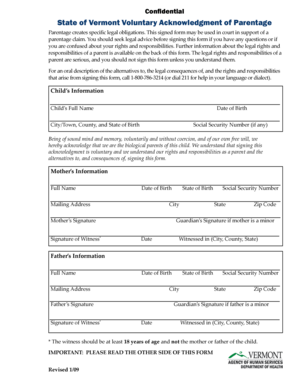

What is 2012 1040a?

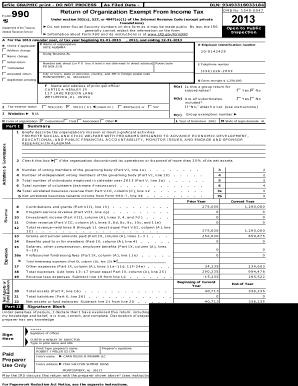

The 2012 1040a is a specific tax form used by individuals to file their federal income tax return for the year 2012. It is intended for taxpayers who have a relatively simple tax situation and don't need to itemize deductions. The 1040a form allows filers to report their income, claim certain tax credits, and calculate their tax liability for that year.

What are the types of 2012 1040a?

There is only one type of 2012 1040a form, and it is designed for individual taxpayers with straightforward tax situations. It can be used by both single filers and married couples filing jointly. However, it cannot be used by taxpayers who need to claim itemized deductions or have more complex tax circumstances.

How to complete 2012 1040a

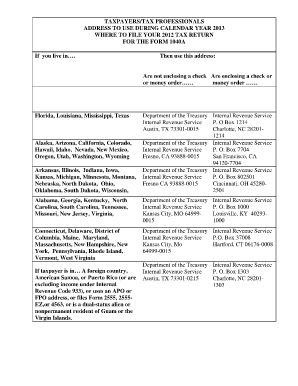

To complete the 2012 1040a form, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.