What is 1040ez instructions 2013?

The 1040ez instructions 2013 refer to the guidelines and guidelines provided by the Internal Revenue Service (IRS) for completing the 1040EZ tax form for the year 2013. These instructions are essential for individuals who meet the criteria for using the 1040EZ form, which is the shortest and simplest form for filing federal income taxes.

What are the types of 1040ez instructions 2013?

There are various types of 1040ez instructions 2013, each addressing specific aspects of completing the tax form. Some of the categories of instructions include:

Instructions for determining eligibility to use the 1040EZ form.

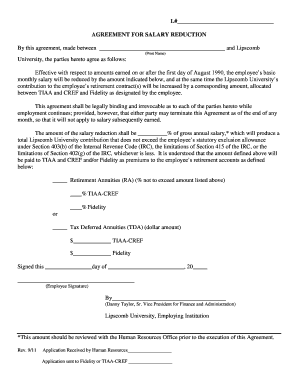

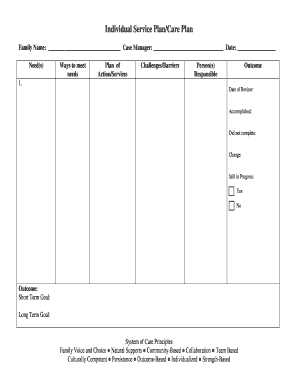

Instructions for entering personal information, such as name, Social Security number, and address.

Instructions for reporting income, including wages, salaries, tips, and taxable interest.

Instructions for claiming deductions and credits, such as the Earned Income Credit or the Child Tax Credit.

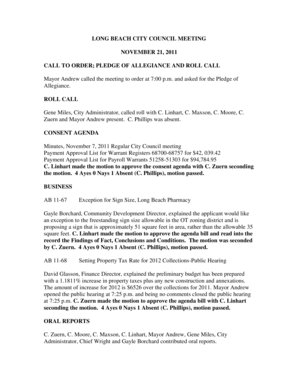

Instructions for calculating and reporting the total tax liability.

Instructions for signing and filing the tax form.

Instructions for any additional schedules or forms that may be required.

How to complete 1040ez instructions 2013

Completing the 1040EZ instructions 2013 is a straightforward process if you follow these steps:

01

Gather all the necessary documents and information, including your Social Security number, income statements, and any applicable deductions or credits.

02

Carefully read and understand the instructions provided by the IRS for each section of the 1040EZ form.

03

Enter your personal information accurately and double-check for any errors or omissions.

04

Report your income and any deductions or credits according to the instructions provided.

05

Calculate your total tax liability and ensure accuracy in the calculations.

06

Sign and date the form before filing.

07

Keep a copy of the completed form and supporting documentation for your records.

When it comes to completing your 1040EZ instructions 2013, you can rely on pdfFiller. pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and accurately.