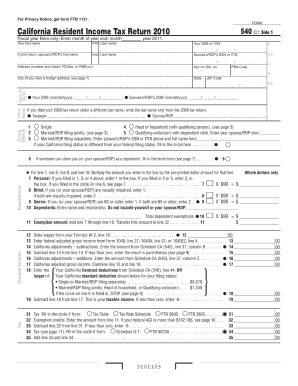

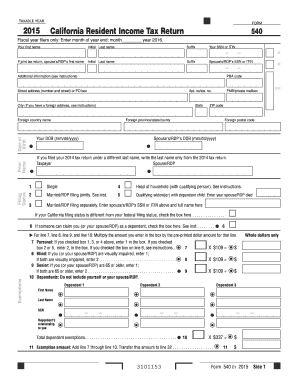

540 Form - Page 2

What is 540 Form?

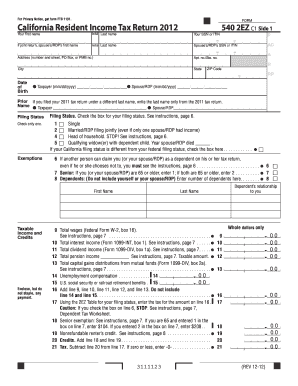

540 Form is a tax form used for reporting income tax returns in the state of California. It is specifically designed for individuals who are residents of California and need to file their state income taxes. This form is used to report various types of income, deductions, credits, and taxes paid by the taxpayer. By completing the 540 Form accurately and timely, taxpayers can ensure compliance with California tax laws and avoid penalties or interest charges.

What are the types of 540 Form?

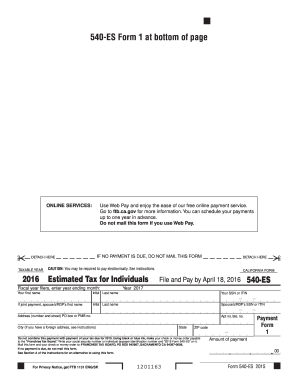

There are several types of 540 Forms that taxpayers may need to use depending on their specific tax situations: 1. Form 540: This is the standard version of the form used by most individuals who are filing their California state income tax return. 2. Form 540NR: This form is for nonresidents or part-year residents of California who need to report their income earned in the state. 3. Form 540X: This is the amended version of the form used to correct any errors or make changes to a previously filed tax return.

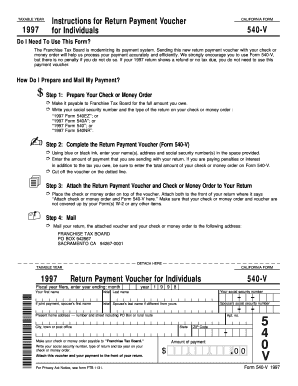

How to complete 540 Form

Completing the 540 Form may seem daunting, but with the right approach, it can be a straightforward process. Follow these steps to complete the form successfully: 1. Gather all necessary documents: Collect all W-2 forms, 1099 forms, and any other relevant financial documents that show your income, deductions, and credits. 2. Fill in personal information: Provide your name, social security number, address, and other required personal details. 3. Report income: Enter the details of your income, including wages, tips, investments, and other sources. 4. Claim deductions and credits: Identify and include any deductions or credits you are eligible for to reduce your taxable income. 5. Calculate your tax liability: Use the provided instructions or tax tables to calculate the amount of tax you owe based on your income and deductions. 6. Sign and file the form: Review your completed form, sign it, and submit it to the appropriate tax authority. By following these steps, you can ensure that your 540 Form is completed accurately and on time, minimizing the risk of errors or delays in processing your tax return.

pdfFiller is an excellent tool to help you complete your 540 Form with ease. With powerful editing tools and unlimited fillable templates, it empowers users to create, edit, and share documents online. Whether you need to fill out your 540 Form, make amendments, or collaborate with others on the document, pdfFiller has all the features you need to get your documents done efficiently and effectively.