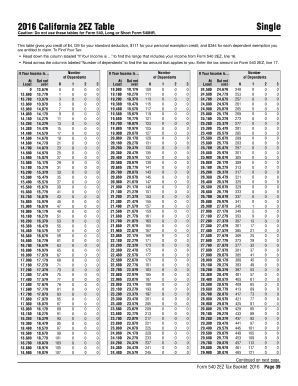

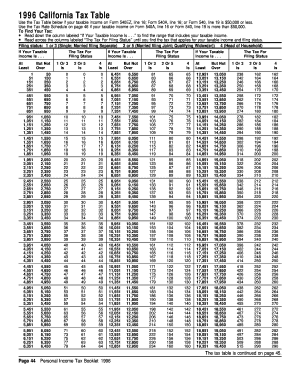

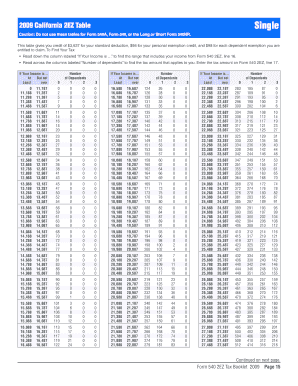

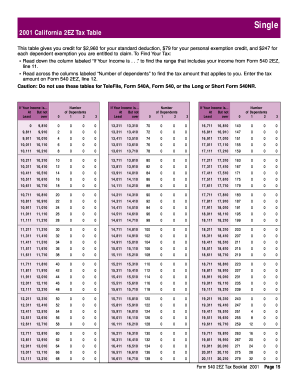

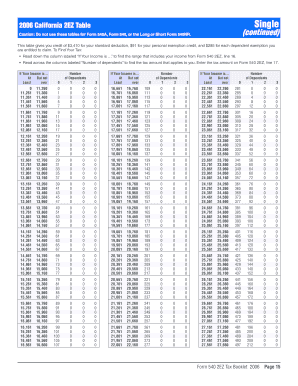

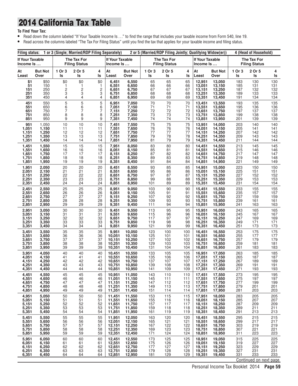

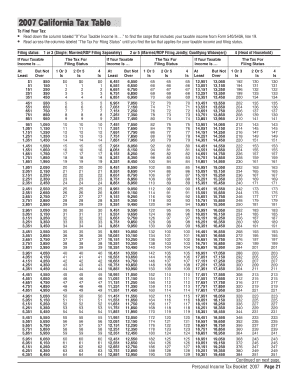

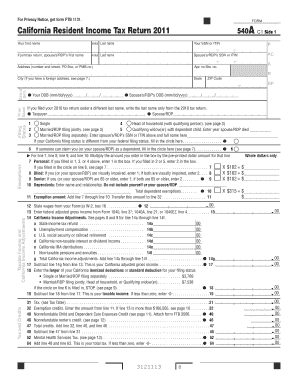

540 Tax Table

What is 540 tax table?

The 540 tax table is a tool used by taxpayers to calculate their state income tax liability in California. It provides a systematic breakdown of tax brackets and corresponding tax rates based on the taxpayer's filing status and income level. By referring to the 540 tax table, individuals can determine how much they owe or if they are entitled to a refund.

What are the types of 540 tax table?

There are three types of 540 tax tables based on the filing status: single, married filing jointly, and head of household. Each table is tailored to the specific filing status and provides the corresponding tax rates and brackets for that particular status.

How to complete 540 tax table

Completing the 540 tax table is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.