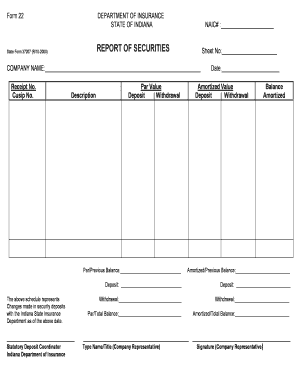

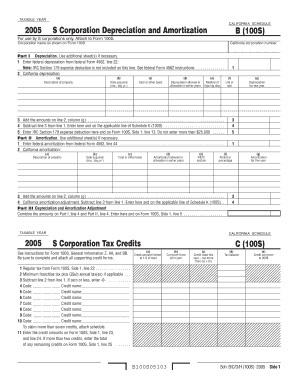

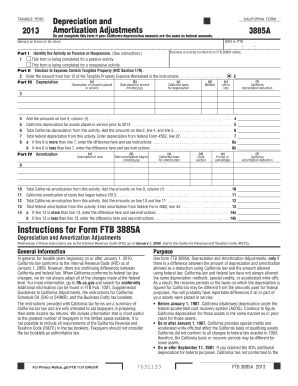

What is Amortization Schedule?

An amortization schedule is a table that provides a detailed breakdown of each periodic payment on a loan. It outlines the amount of principal and interest included in each payment, as well as the remaining balance after each payment. This schedule helps borrowers understand how their loan payments are applied over time.

What are the types of Amortization Schedule?

There are two main types of amortization schedules:

Fixed Amortization Schedule: This is the most common type, where the principal and interest are divided into equal payments over the loan term. Each payment contributes to reducing the principal balance, resulting in a gradual decrease in debt.

Graduated Payment Amortization Schedule: In this type, the payments start low and gradually increase over time. It is suitable for borrowers who expect their income to rise in the future, allowing them to start with smaller payments and adjust as their income grows.

How to complete Amortization Schedule

Completing an amortization schedule involves the following steps:

01

Gather all necessary loan information, including the principal amount, interest rate, loan term, and start date.

02

Use an online amortization calculator or spreadsheet to generate the schedule. Input the loan information and calculate the periodic payment amount.

03

Create a table with columns for payment number, payment date, principal payment, interest payment, and remaining balance.

04

Fill in the table by applying the periodic payments to the principal and interest portions, reducing the balance accordingly.

05

Repeat the process for each payment, updating the remaining balance after each payment is made.

06

Review and double-check the completed amortization schedule for accuracy.

Creating an accurate and detailed amortization schedule is crucial for borrowers to stay informed about their loan payments and track their progress towards debt repayment. To easily and efficiently create, edit, and share amortization schedules, as well as other important documents, pdfFiller offers unlimited fillable templates and powerful editing tools. With pdfFiller, you have everything you need to effectively manage your loan payments and financial obligations.