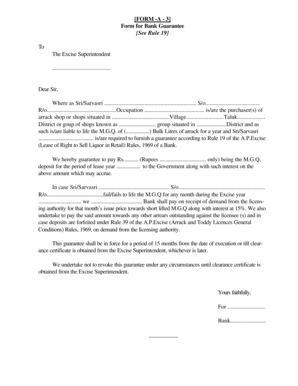

Bank Guarantee Draft

What is bank guarantee draft?

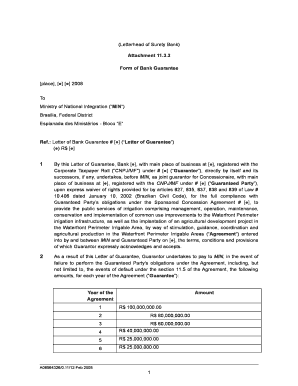

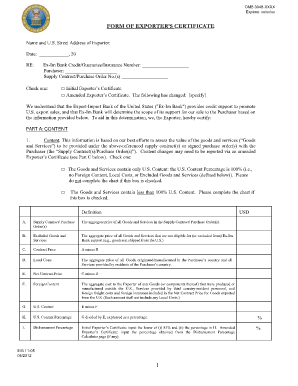

A bank guarantee draft is a legal document that represents a commitment made by a bank to pay a specified amount of money to a beneficiary if the primary party (usually the borrower) fails to fulfill their contractual obligations. It serves as a form of security for both parties involved in a business transaction.

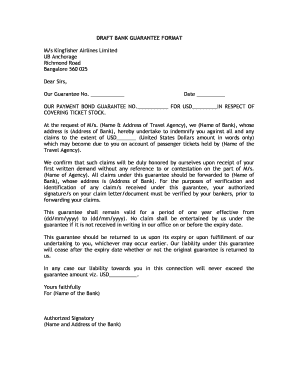

What are the types of bank guarantee draft?

Bank guarantee drafts can be classified into various types based on their purpose and nature. Some common types include:

Bid Bond: A type of bank guarantee draft used in bidding processes to ensure that the winning party will fulfill their contractual obligations.

Performance Guarantee: This type of bank guarantee ensures that the contracted party will complete a project or deliver goods/services as agreed.

Advance Payment Guarantee: It guarantees the reimbursement of advance payments made by the beneficiary in case the primary party fails to fulfill their obligations.

Financial Guarantee: Used to secure financial obligations, such as loans, ensuring repayment of the borrowed amount.

Payment Guarantee: This bank guarantee draft assures the beneficiary that the bank will make payment on behalf of the primary party in case of default.

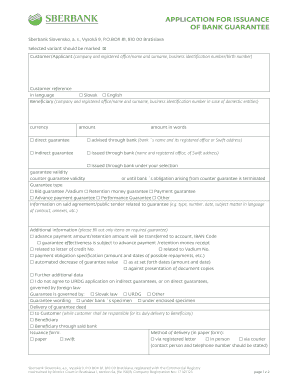

How to complete bank guarantee draft

Completing a bank guarantee draft involves the following steps:

01

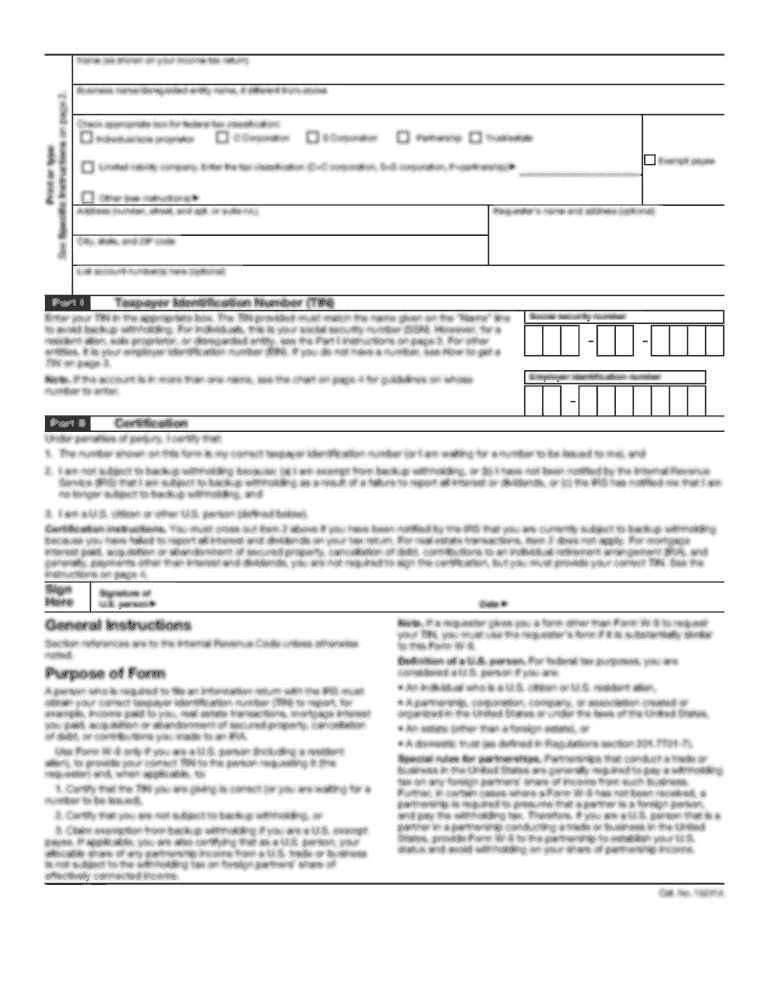

Gather the necessary information: Collect all the required details, such as the beneficiary's name, amount, terms and conditions, and any supporting documents.

02

Fill in the draft: Use a reliable tool, like pdfFiller, to input the gathered information accurately into the bank guarantee draft.

03

Review and verify: Double-check all the entered details to ensure accuracy and review the draft to ensure it aligns with the requirements.

04

Get it authorized: Once reviewed, obtain the necessary authorizations from relevant parties, such as the bank and the primary party involved.

05

Share the draft: Finally, share the completed bank guarantee draft with all the involved parties through a secure and efficient platform like pdfFiller, enabling easy collaboration and sign-off.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out bank guarantee draft

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself