Business Budget Template 2 Monthly - Page 2

What is Business Budget Template 2 Monthly?

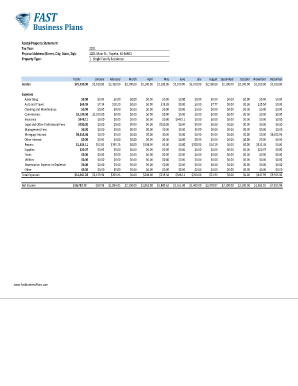

Business Budget Template 2 Monthly is a financial planning tool that helps businesses track their income and expenses on a monthly basis. It allows users to set budget goals, monitor their financial performance, and make informed decisions to improve profitability.

What are the types of Business Budget Template 2 Monthly?

There are several types of Business Budget Template 2 Monthly templates available, including:

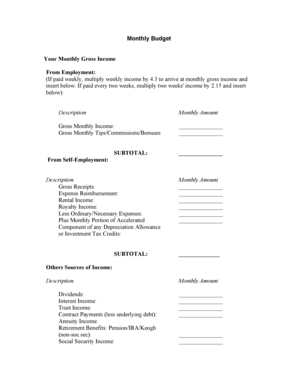

Simple Monthly Budget Template

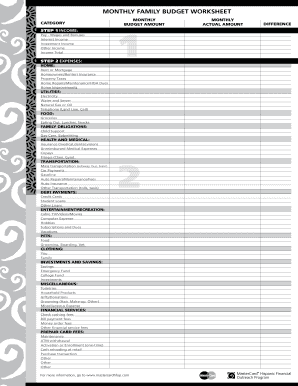

Detailed Monthly Budget Template

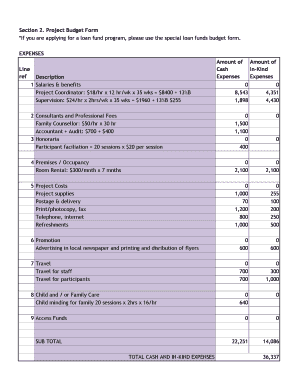

Project-Based Monthly Budget Template

Department-Wise Monthly Budget Template

How to complete Business Budget Template 2 Monthly

Completing a Business Budget Template 2 Monthly is easy and straightforward. Here are the steps:

01

Start by entering your business name and the month for which the budget is being created.

02

Fill in the fields for income sources, such as sales revenue, investments, and loans.

03

Enter the expenses categories, including payroll, utilities, rent, and supplies.

04

Calculate the total income and expenses to determine your net profit or loss.

05

Compare your actual financial performance to the budgeted amounts and analyze any discrepancies to make adjustments for the future.

06

Save and share the completed Business Budget Template 2 Monthly with key stakeholders for review and decision-making.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you create a simple business budget?

How to create a business budget: A 6-step guide Examine your revenue. Subtract fixed costs. Determine variable expenses. Set aside a contingency fund for unexpected costs. Create your profit and loss statement. Outline your forward-looking business budget.

How do you budget monthly expenses for a business?

How to create a business budget: A 6-step guide Examine your revenue. Subtract fixed costs. Determine variable expenses. Set aside a contingency fund for unexpected costs. Create your profit and loss statement. Outline your forward-looking business budget.

What are the 3 types of budgets?

The three types of annual Government budgets based on estimates are Surplus Budget, Balanced Budget, and Deficit Budget.

How much should a small business spend on expenses?

The Profit First system highlights that business expenses should be no more than 30% of total revenue. He suggests that this strategy will ensure profitability and if there isn't enough leftover after profit and compensation to cover expenses, then expenses should be cut.

How do you budget expenses for a business?

What's a Business Budget—and Why Is It Important? Step 1: Tally Your Income Sources. Step 2: Determine Fixed Costs. Step 3: Include Variable Expenses. Step 4: Predict One-Time Spends. Step 5: Pull It All Together. Use Your Budget to Stay on Track.

How do you write a business budget template?

How to create a budget for a business Calculate all forms of income. Subtract your fixed expenses. Subtract your variable expenses. Prepare for emergency and one-time expenses. Create a profit and loss statement. Draft your business budget.