Business Proposal For Bank Loan Template

What is Business Proposal For Bank Loan Template?

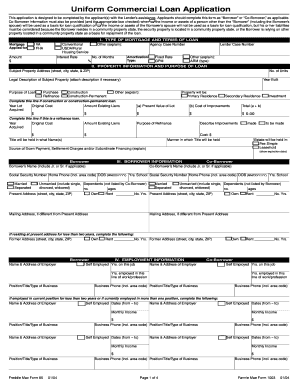

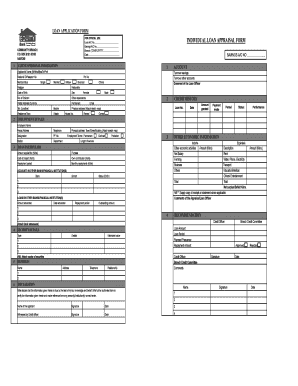

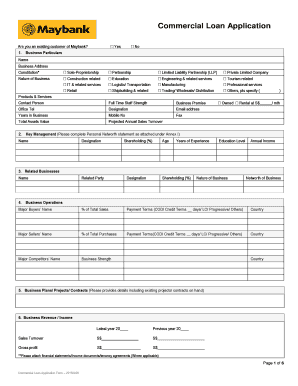

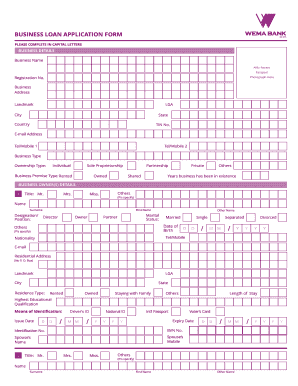

A Business Proposal For Bank Loan Template is a document that outlines the details of a business project or venture and is submitted to a bank or financial institution to apply for a loan. It provides an overview of the business, including its goals, financial projections, and how the loan will be used.

What are the types of Business Proposal For Bank Loan Template?

There are different types of Business Proposal For Bank Loan Templates, depending on the purpose and nature of the loan. Some common types include: 1. Startup Business Proposal: This template is used by entrepreneurs to seek funding for a new business idea or venture. 2. Expansion Business Proposal: This template is used by existing businesses that want to expand their operations or enter new markets. 3. Acquisition Business Proposal: This template is used when seeking funds for acquiring another business or company. 4. Working Capital Loan Proposal: This template is used by businesses to secure funds for their day-to-day operations and cash flow needs.

How to complete Business Proposal For Bank Loan Template

Completing a Business Proposal For Bank Loan Template involves several key steps: 1. Introduction: Provide a brief overview of your business, its history, and the purpose of the loan. 2. Executive Summary: Summarize the highlights of your proposal, including the amount of loan requested, repayment terms, and the potential benefits for the bank. 3. Business Description: Provide detailed information about your business, including its legal structure, products or services, target market, and competitive advantage. 4. Financial Projections: Present your financial forecasts, including projected revenue, expenses, cash flow, and profitability. This section should demonstrate the viability and profitability of your business. 5. Loan Repayment Plan: Outline how you intend to repay the loan, including the repayment period, interest rate, and any collateral or guarantors. 6. Supporting Documents: Attach any relevant supporting documents, such as financial statements, business plans, market research, and legal contracts. 7. Conclusion: Summarize your proposal and express gratitude for the opportunity to submit it. Remember to tailor your proposal to the specific requirements of the bank or financial institution you are applying to.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.