Christmas Budget - Page 2

What is Christmas Budget?

Christmas Budget refers to the amount of money that an individual or a family sets aside specifically for spending on Christmas-related expenses. It helps to plan and manage finances effectively during the holiday season.

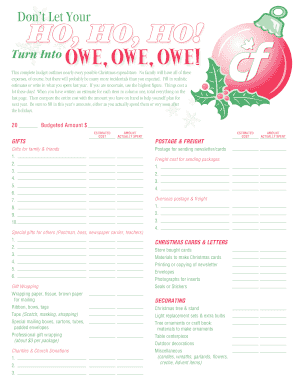

What are the types of Christmas Budget?

There are different types of Christmas Budget that one can choose based on their preferences and financial situation:

Fixed Budget: In this type, a predetermined amount is set for Christmas expenses, and it cannot be exceeded.

Flexible Budget: This type allows for adjustments and changes as needed during the holiday season.

Savings Budget: Here, the budget is set by saving a certain amount of money each month leading up to Christmas.

Zero-Based Budget: This budgeting approach involves allocating every dollar towards a specific expense, including Christmas-related costs.

How to complete Christmas Budget

Completing a Christmas Budget can be done in a few simple steps:

01

Determine your total Christmas budget based on your financial capability.

02

Make a list of all the Christmas-related expenses you anticipate, including gifts, decorations, food, and travel expenses.

03

Assign a specific amount for each expense category based on your budget.

04

Track your spending throughout the holiday season to ensure you stay within your set budget.

05

Make adjustments if necessary, but try to stick to your budget as much as possible.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Christmas Budget

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a good budget for Christmas?

For a family of four to set a Christmas gift-giving budget of 4% of the household's annual budget means that during the month of December they might spend 48% of their month's take home pay on Christmas gifts that month.

How do you layout a budget?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

How do you write a proper budget?

How do I make a budget? Write down your expenses. Expenses are what you spend money on. Bills: Other expenses, like: Write down how much money you make. This includes your paychecks and any other money you get, like child support. Subtract your expenses from how much money you make. This number should be more than zero.

What are the 7 steps to planning a budget?

How to make a budget in 7 steps Figure out your income. Start by making a list of all the money you have coming in each month. Map out your expenses. Figure out where your money is going by making a list of your expenses each month. Calculate your balance. Identify your goals. Make a plan. Stay on track. Talk to an expert.

How much money should I budget for Christmas?

According to personal finance expert Gregory Karp, you should spend no more than 1.5 percent of the annual family gross income on presents. If you have many deductions from your gross pay, you may spend a larger percentage of your take-home wages.

How do I turn an Excel spreadsheet into Christmas?

How to Make a Christmas List in Microsoft Excel (Guide with Pictures) Step 1: Open Excel and create a new workbook. Step 2: Click inside cell A1, type “Recipient”, click inside cell B1, type “Gift”, then click inside cell C1 and type “Price.” Step 3: Enter the information for your first gift into row 2.