What is college student budget template?

A college student budget template is a useful tool that helps college students track their expenses and income. It provides a structured format where students can list their monthly expenses, such as tuition fees, rent, groceries, transportation, and entertainment. By using a budget template, college students can have a clear overview of their finances and make informed decisions to manage their money effectively.

What are the types of college student budget template?

There are several types of college student budget templates available, each designed to cater to different needs and preferences. Some common types include:

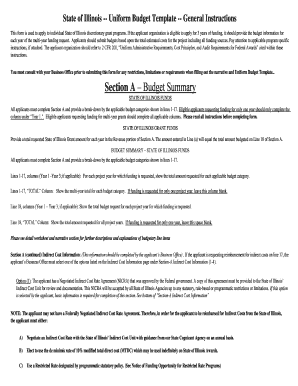

Basic budget template: This template provides a simple format with categories for income and expenses, allowing students to input their financial information easily.

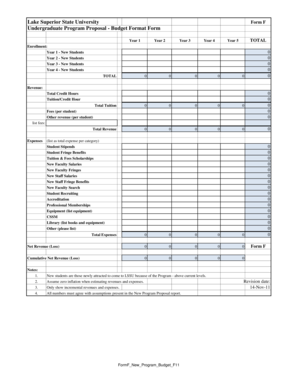

Detailed budget template: This template offers more specific categories and subcategories to track expenses in detail. It is suitable for students who want a comprehensive view of their spending habits.

Weekly budget template: This template breaks down the budget on a weekly basis, helping students to manage their finances more efficiently.

Monthly budget template: This template focuses on monthly expenses and income, providing a broader perspective on overall financial health.

How to complete college student budget template?

Completing a college student budget template is a straightforward process. Here are the steps to follow:

01

Gather financial information: Collect all your financial statements, such as bank statements, credit card bills, and receipts.

02

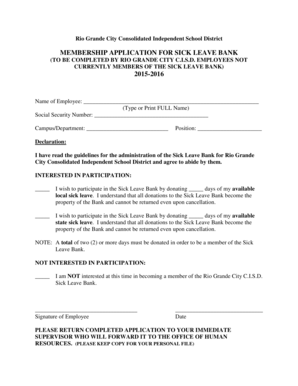

Identify income sources: Make a list of all the sources of income, including part-time jobs, scholarships, and allowances.

03

List expenses: Categorize your expenses, such as tuition fees, rent, utilities, groceries, transportation, and entertainment. Be thorough to ensure a comprehensive budget.

04

Track expenses: Record your expenses regularly, either manually or using budgeting apps or software.

05

Adjust and analyze: Review your budget regularly, identify areas where you can cut back or save, and make adjustments accordingly.

06

Monitor and revisit: Keep track of your budget and revisit it periodically to ensure you're staying on track and meeting your financial goals.

With pdfFiller, you can create, edit, and share your college student budget template online. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the only PDF editor you need to efficiently manage your documents.