Corporate Guarantee Vs Personal Guarantee - Page 2

What is corporate guarantee vs personal guarantee?

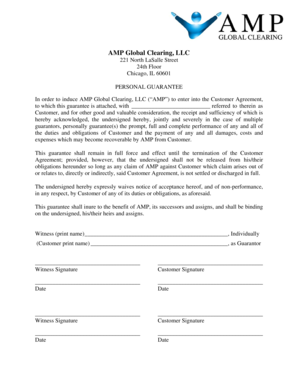

A corporate guarantee and a personal guarantee are both legally binding agreements that provide assurance or security for a particular transaction or agreement. However, there are some key differences between the two. A corporate guarantee is a guarantee given by a corporation on behalf of another entity, such as a subsidiary or affiliate company, to ensure the fulfillment of a contractual obligation. It typically involves the parent company taking responsibility for the actions or debts of the subsidiary. On the other hand, a personal guarantee is an individual's commitment to be personally responsible for the obligations of another party. This means that if the primary entity fails to meet its obligations, the guarantor's personal assets can be used to satisfy the debt or obligation. Both corporate and personal guarantees serve as a form of protection for the creditor or the party receiving the guarantee, but they differ in terms of who is providing the guarantee and what assets are at stake.

What are the types of corporate guarantee vs personal guarantee?

There can be different types of corporate and personal guarantees, depending on the specific circumstances and agreements involved. Some common types include: - Corporate Guarantees: 1. Guarantees provided by a parent company for its subsidiaries or affiliated companies. 2. Guarantees provided by a holding company for its subsidiary companies. 3. Guarantees provided by one corporate entity for another corporate entity, such as a joint venture or partnership. - Personal Guarantees: 1. Guarantees provided by individuals for business loans or credit facilities. 2. Guarantees provided by directors or executives of a company for company debts or obligations. 3. Guarantees provided by partners or shareholders of a partnership or LLC for partnership/LLC debts or obligations.

How to complete corporate guarantee vs personal guarantee

Completing a corporate or personal guarantee requires careful consideration and attention to detail. Here are some steps to follow: 1. Understand the terms and conditions of the guarantee: Read the guarantee document thoroughly and make sure you fully understand the obligations and responsibilities involved. 2. Seek legal advice if necessary: If you are unsure about any aspect of the guarantee or its implications, consult with a legal professional who specializes in contract law. 3. Assess the risks and potential consequences: Consider the financial and legal risks associated with providing a guarantee, as well as the potential impact on your personal assets or creditworthiness. 4. Negotiate the terms if possible: If you have concerns or would like to modify certain aspects of the guarantee, discuss them with the other party involved and try to reach a mutually beneficial agreement. 5. Sign the guarantee document: Once you are satisfied with the terms and have decided to proceed, sign the guarantee document in the presence of witnesses, if required. 6. Keep a copy of the guarantee: Make sure to keep a copy of the signed guarantee document for your records and future reference.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.