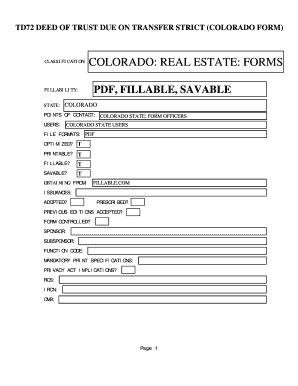

Deed Of Trust Form Pdf

What is deed of trust form pdf?

A deed of trust form PDF is a legal document that outlines the terms and conditions of a real estate transaction involving a loan. It serves as a security instrument, providing protection to the lender by giving them a claim on the property in case of default. The PDF format ensures that the document can be easily accessed, shared, and printed.

What are the types of deed of trust form pdf?

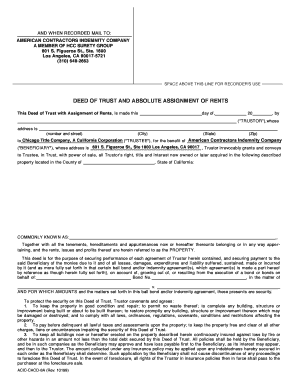

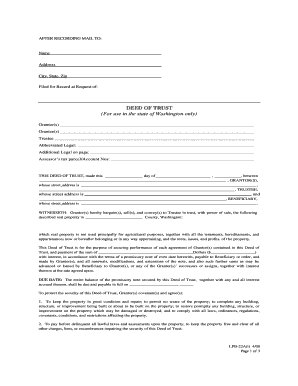

There are several types of deed of trust forms available in PDF format to suit different real estate transactions. Some common types include: 1. Standard Deed of Trust: This is the most common type, used in typical buying and selling of property. 2. Deed of Trust with Assignment of Rents: This type allows the lender to collect rent from the property in case of default. 3. Deed of Trust with Power of Sale: This type gives the lender the power to sell the property in case of default. 4. Deed of Trust for Co-Ownership: This type is used when multiple parties own the property together. 5. Deed of Trust Subordination Agreement: This type establishes the priority of multiple loans on a property.

How to complete deed of trust form pdf

Completing a deed of trust form PDF is a straightforward process. Here are the steps to follow: 1. Download the deed of trust form PDF from a reputable source. 2. Open the PDF with a reliable PDF editor, such as pdfFiller. 3. Fill in the required information, including the names of the parties involved, property details, loan terms, and any additional clauses. 4. Review the completed form for accuracy and make any necessary edits. 5. Save the filled-out form and share it with the appropriate parties. 6. Keep a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.