What is a donation form receipt?

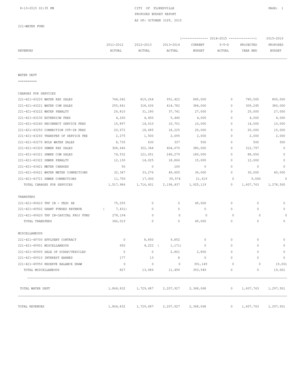

A donation form receipt is a document that acknowledges a donation made by an individual or organization. It serves as proof of the donation for both the donor and the recipient. A donation form receipt typically includes information such as the donor's name, the date of the donation, the amount donated, and the recipient's information. It is an essential document for tax purposes and provides accountability for both parties involved.

What are the types of donation form receipt?

There are several types of donation form receipts that can be used depending on the nature of the donation and the preferences of the organization. Some common types include:

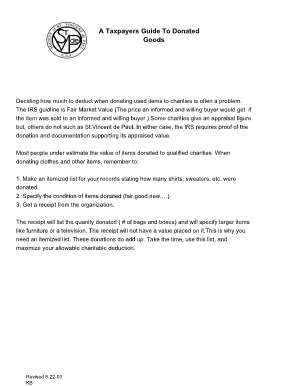

Standard donation form receipt: This is the most basic type of receipt, providing essential information about the donation.

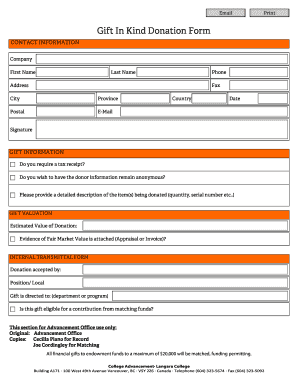

In-kind donation form receipt: This receipt is used for non-cash contributions such as goods or services.

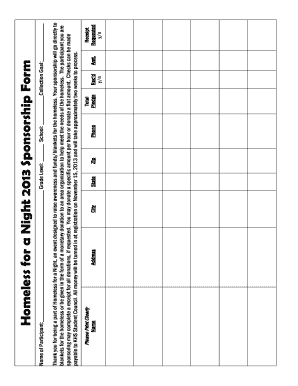

Event-specific donation form receipt: For donations made during specific fundraising events or campaigns.

Membership donation form receipt: Designed for organizations that offer membership benefits in exchange for donations.

Corporate donation form receipt: Tailored for corporate donors, including additional information such as company details.

How to complete a donation form receipt

Completing a donation form receipt is a straightforward process. Here are the steps to follow:

01

Start with the recipient's information: Include the name, address, and contact details of the organization receiving the donation.

02

Add the donor's information: Enter the name, address, and contact details of the individual or organization making the donation.

03

Specify the donation details: Include the date of the donation, the amount donated, and any specific instructions or designations.

04

Provide acknowledgment: Express gratitude to the donor for their generous contribution.

05

Include tax information: If applicable, provide details on tax deductibility or any tax-related benefits.

06

Ensure compliance: Double-check that the receipt complies with any legal requirements or regulations pertaining to the organization or the donation.

07

Save a copy: Keep a record of the completed donation form receipt for future reference and auditing purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.