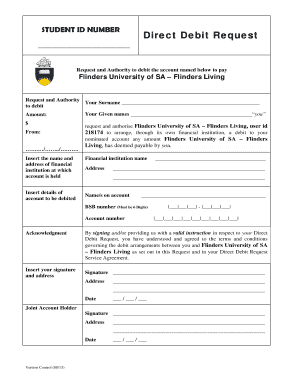

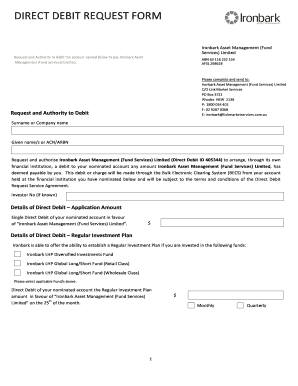

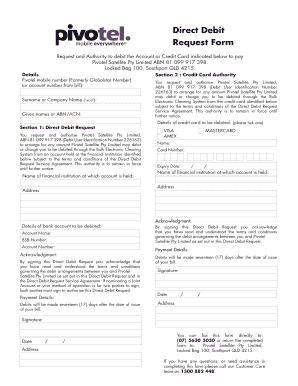

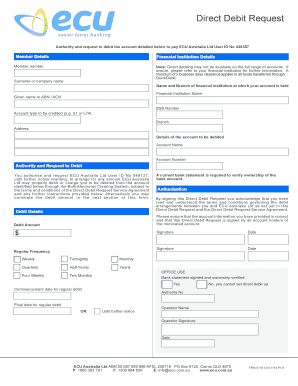

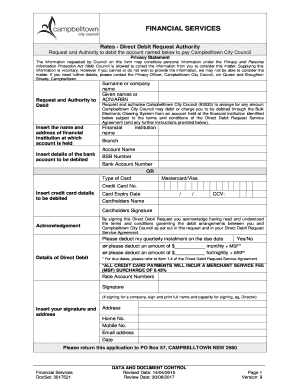

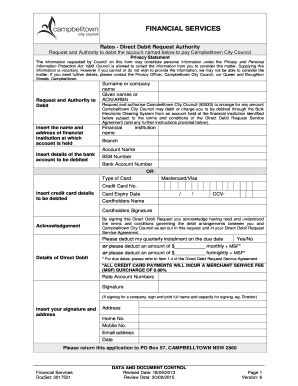

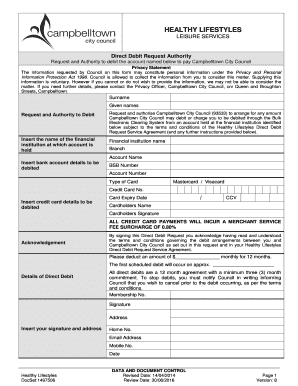

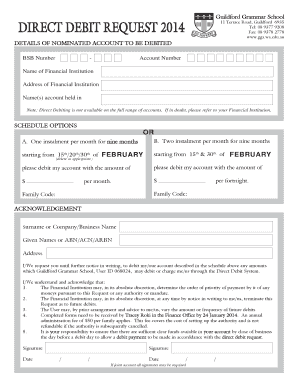

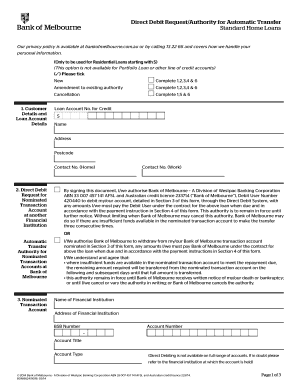

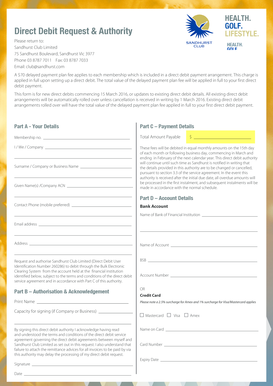

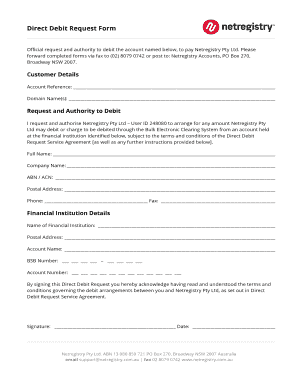

Direct Debit Request Authority Form

What is direct debit request authority form?

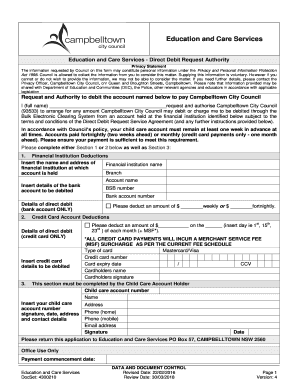

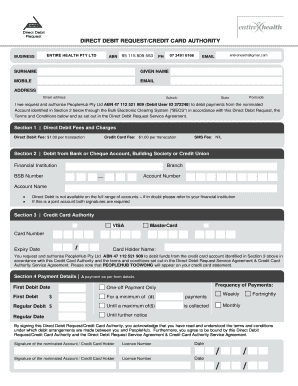

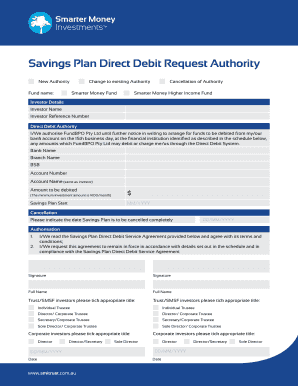

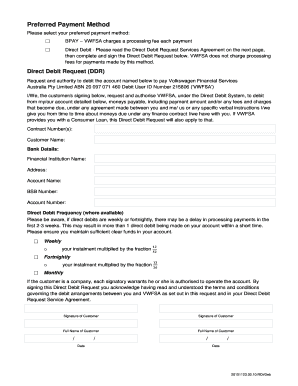

A direct debit request authority form is a document that authorizes a company or organization to collect payments directly from a customer's bank account. It is a convenient and secure way to make recurring payments, such as utility bills or subscription fees. By completing this form, the customer gives the company permission to deduct the necessary funds from their bank account on a set schedule.

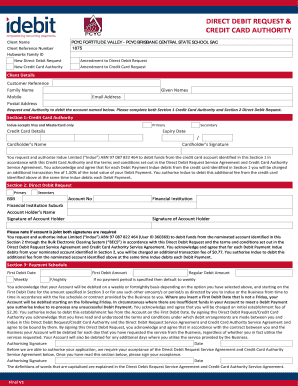

What are the types of direct debit request authority form?

There are two main types of direct debit request authority forms:

Personal direct debit request authority form: This form is used by individuals to authorize a company to debit payments from their personal bank account.

Business direct debit request authority form: This form is used by businesses to authorize another business or organization to debit payments from their business bank account.

How to complete direct debit request authority form

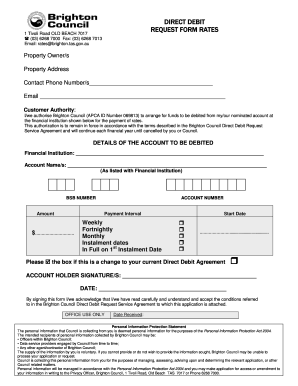

Completing a direct debit request authority form is a straightforward process. Here are the steps:

01

Fill in your personal or business details, including your name, address, and contact information.

02

Provide your bank account details, such as the account number and the name of the bank.

03

Specify the payment amount and frequency, indicating how often and how much should be debited from your account.

04

Sign and date the form to acknowledge your authorization.

05

Submit the form to the company or organization that requires it.

By following these steps, you are ensuring that the direct debit authority form is completed accurately and in a timely manner.

Video Tutorial How to Fill Out direct debit request authority form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you set up a mandate?

Click on the 'View and Generate' option for the relevant investor and bank account. On the following screen, select the 'Generate e-Mandate' option. You can set the daily limit for the e-mandate by clicking on the drop-down in front of 'Maximum per-day amount for the mandate.

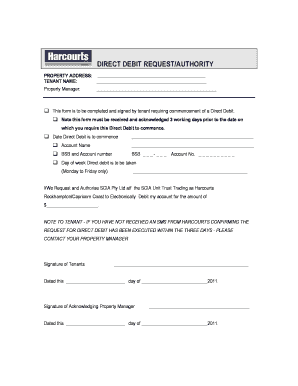

What is a Direct Debit mandate form?

A Direct Debit mandate gives service providers written permission to take payments from their customers bank accounts. Payments cannot be collected until the mandate has been signed and agreed by the customer. Direct Debits are the safest and most trusted method of collecting recurring payments.

How do I issue a Direct Debit mandate?

How can I set up a Direct Debit mandate? Prepare a mandate form and give it to your customer. To set up a Direct Debit mandate, your customer will need to complete a mandate form. Customers complete, sign and return the mandate. Submit the completed mandate to the bank.

Can a Direct Debit mandate be emailed?

Can we take a Direct Debit Instruction (DDI) via email? No, not by just taking their bank details in an email. You could potentially accept a scanned signed paper Direct Debit Instruction.

How do I get customers to pay by Direct Debit?

Setting up direct debits - how it works Step 1: Get in touch with your bank. Before you do anything else, contact your bank and let them know you'd like to join the Direct Debit Scheme. Step 2: Choose a direct debit company. Step 3: Get direct debit mandates from your customers.

How do I get a Direct Debit mandate form?

The three most common ways to do so are: Paper - A paper Direct Debit Instruction form can be completed by your customer and returned to you. Telephone - Your customer's details can be collected over the phone, using a bank-approved script. Online - An electronic mandate form can be completed by your customer.