Donation Receipt Letter Template - Page 7

What is Donation Receipt Letter Template?

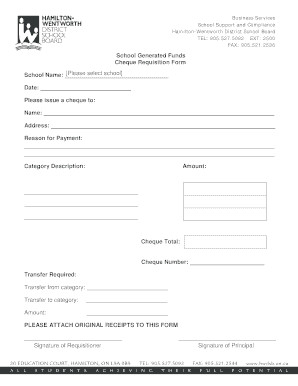

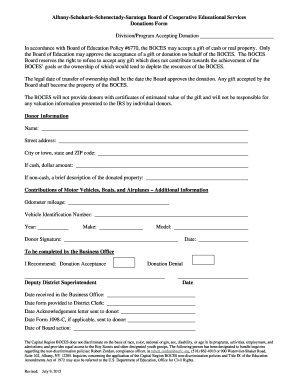

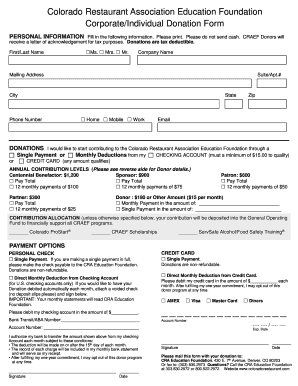

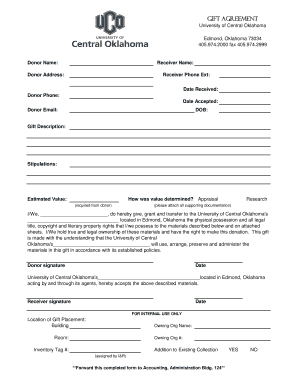

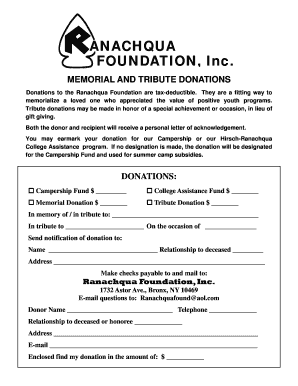

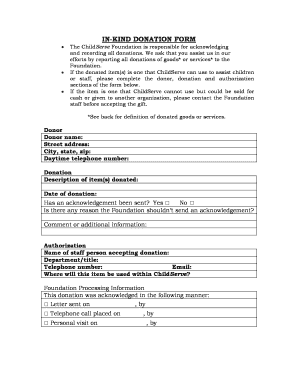

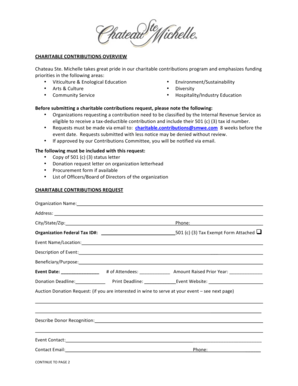

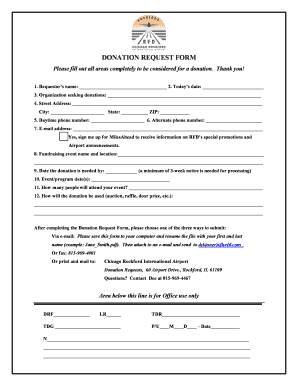

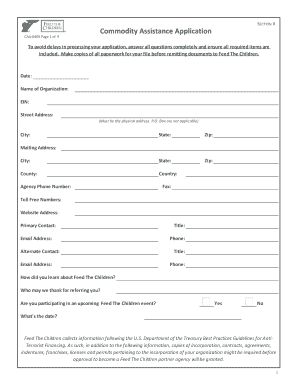

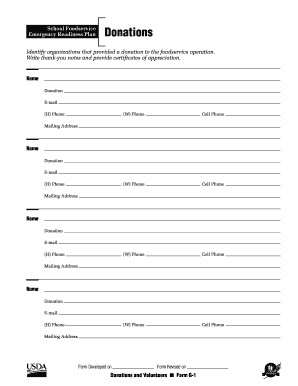

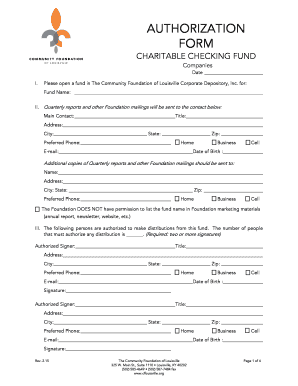

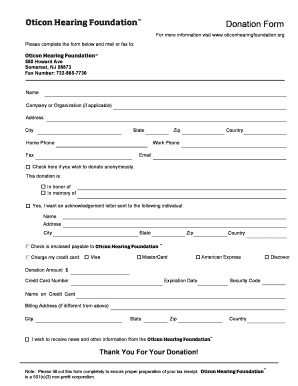

A donation receipt letter template is a document that organizations use to acknowledge and thank individuals or businesses for their contributions or donations. This letter serves as proof of donation for the donor and can be used for tax purposes. It also helps build a positive relationship between the organization and the donor.

What are the types of Donation Receipt Letter Template?

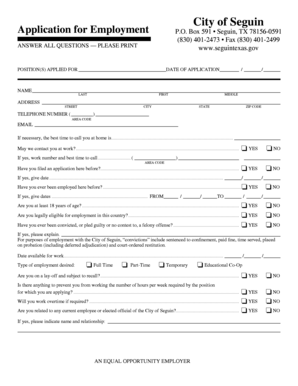

There are different types of donation receipt letter templates available, depending on the organization's needs and the type of donation. Some common types include:

How to complete Donation Receipt Letter Template

To complete a donation receipt letter template, follow these steps:

pdfFiller empowers users to create, edit, and share documents online, including donation receipt letter templates. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for individuals and organizations to streamline their document workflows.