Escrow Agreement

What is Escrow Agreement?

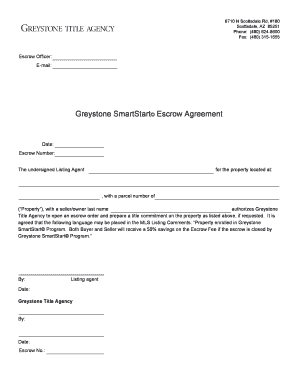

An Escrow Agreement is a legal arrangement where a neutral third party, known as an escrow agent, holds and regulates funds or assets on behalf of two parties involved in a transaction. This agreement ensures that both parties fulfill their obligations, minimizing the risk for each party. The escrow agent holds the funds or assets until all terms and conditions of the agreement are met.

What are the types of Escrow Agreement?

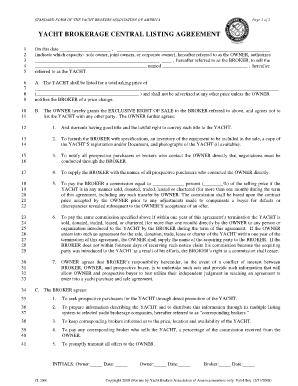

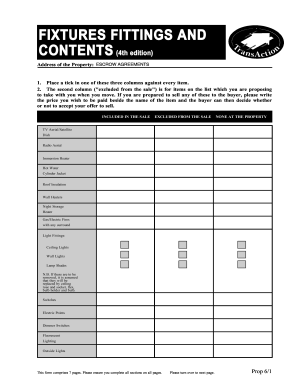

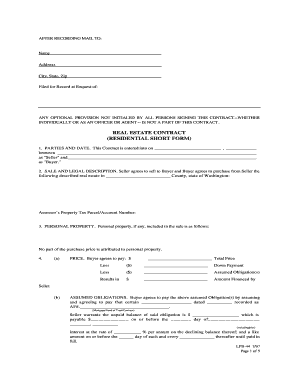

There are various types of Escrow Agreements, each designed for different purposes. Some common types include: 1. Real Estate Escrow Agreement: Used in real estate transactions to ensure the safe transfer of funds and property titles. 2. Software Escrow Agreement: Helps protect the interests of software licensees by holding the source code in escrow, allowing access in certain agreed-upon situations. 3. Mergers and Acquisitions Escrow Agreement: Used in mergers and acquisitions to ensure financial security and mitigate risks for the involved parties.

How to complete Escrow Agreement

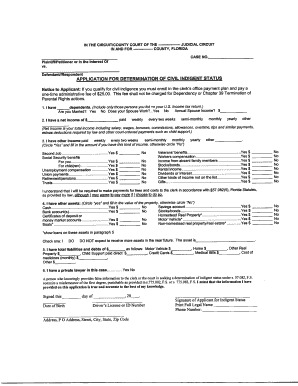

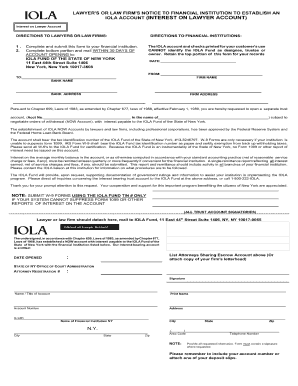

Completing an Escrow Agreement involves a series of steps to ensure a smooth and secure transaction. Here is a general outline of the process: 1. Identify the parties involved: Clearly state the names and contact information of all parties participating in the agreement. 2. Define the terms and conditions: Outline the specific obligations and responsibilities of each party, including deadlines for completion. 3. Determine the escrow agent: Select a neutral and trusted escrow agent to hold and manage the funds or assets involved. 4. Establish the escrow account: Open an escrow account with the chosen agent and deposit the agreed-upon funds or assets. 5. Monitor the progress: Regularly communicate and track the progress of the transaction with all parties involved. 6. Release of funds or assets: Once all conditions are met, the escrow agent releases the funds or assets to the appropriate party.

With pdfFiller, completing an Escrow Agreement becomes even more convenient. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.