Form 4506-t How Long Does It Take

What is form 4506-t how long does it take?

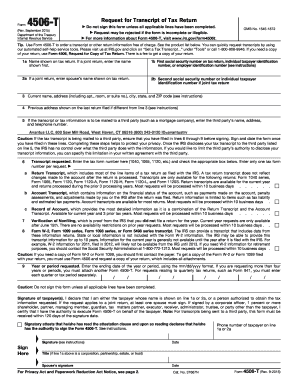

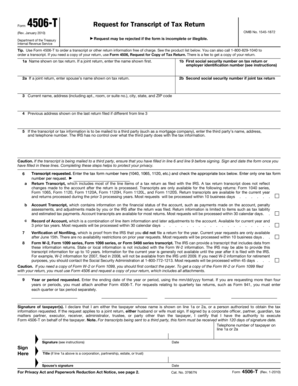

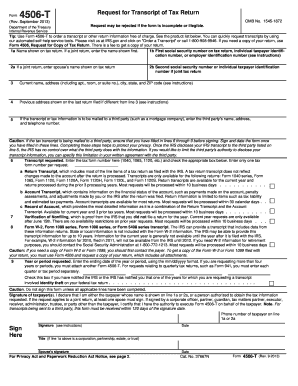

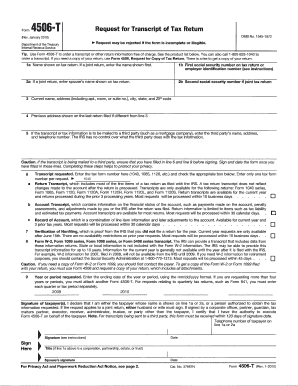

Form 4506-t is a document used by taxpayers to request a transcript of their tax return. It is commonly used for mortgage applications, loan approvals, and income verification purposes. The processing time for form 4506-t may vary depending on the method of submission and the volume of requests received by the IRS. Generally, it takes around 5 to 10 business days for the IRS to process and provide the requested transcript to the taxpayer.

What are the types of form 4506-t how long does it take?

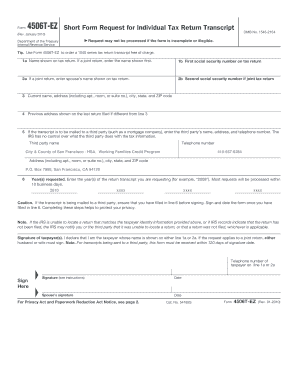

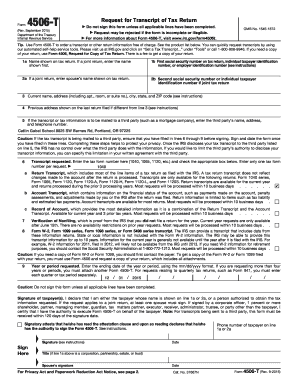

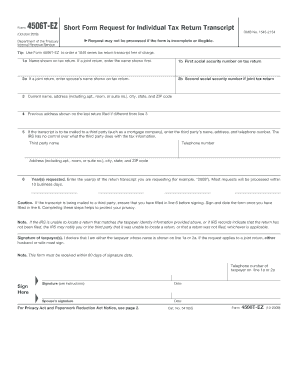

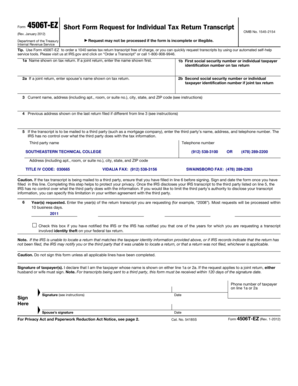

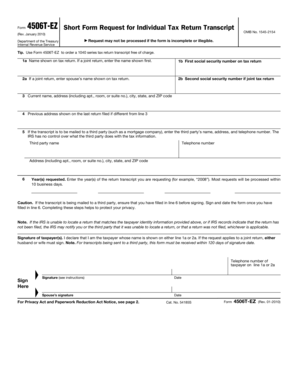

There are three types of form 4506-t: 1. Form 4506-T: This is the standard form used to request a tax return transcript. The processing time for this form is usually 5 to 10 business days. 2. Form 4506-T-EZ: This form is a simplified version of form 4506-t and is used for individuals who filed a Form 1040 series return. The processing time for this form is also around 5 to 10 business days. 3. Form 4506-T Request for Transcript of Tax Return: This is a specialized version of form 4506-t used by businesses, partnerships, and corporations to request a tax return transcript. The processing time for this form may take longer, typically around 30 calendar days.

How to complete form 4506-t how long does it take?

Completing form 4506-t is a straightforward process. Here are the steps to follow: 1. Download Form 4506-t from the official IRS website or use a reliable online platform like pdfFiller. 2. Provide your personal information such as name, address, social security number, and phone number. 3. Specify the type of transcript you need and the tax year(s) you want information for. 4. Sign and date the form. 5. Submit the completed form to the IRS via mail, fax, or online submission. The processing time for form 4506-t, as mentioned earlier, is typically 5 to 10 business days. However, using an online platform like pdfFiller can expedite the process, saving you valuable time and effort.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.