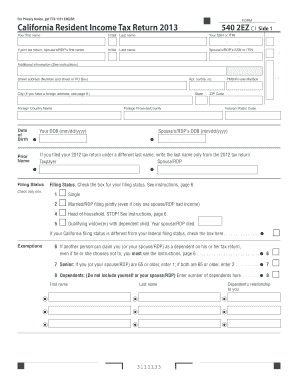

Form 540 2ez

What is form 540 2ez?

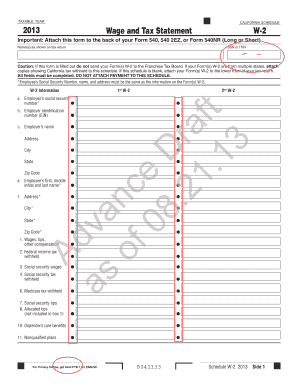

Form 540 2ez is a simplified version of California's income tax return form. It is specifically designed for individuals with simple tax situations and allows them to easily report their income, claim deductions, and calculate their tax liability. This form is ideal for those who have a straightforward tax situation and do not need to itemize deductions or claim complex tax credits.

What are the types of form 540 2ez?

There is only one type of form 540 2ez. It is a short form that provides a simplified way for individuals to file their California income tax return. This form is specifically tailored for individuals with uncomplicated tax situations and limits the deductions and tax credits that can be claimed. It is important to ensure that you meet the eligibility requirements to use form 540 2ez before choosing this filing option.

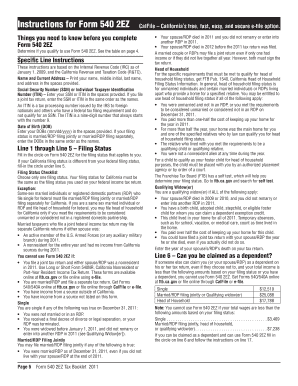

How to complete form 540 2ez

Completing form 540 2ez is relatively simple and straightforward. Here is a step-by-step guide to help you complete the form:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and hassle-free.