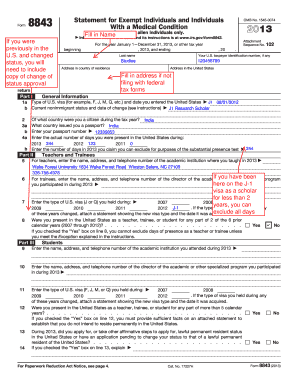

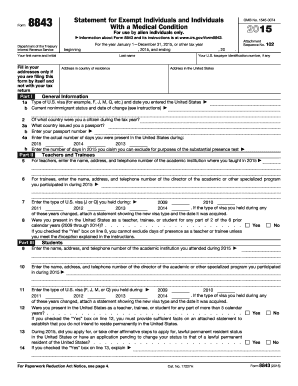

Form 8843 Sample

What is form 8843 sample?

Form 8843 sample is a document used by individuals who are not U.S. citizens or residents for tax purposes. It is specifically for those who need to demonstrate their substantial presence in the United States but do not qualify as a resident alien. This form is crucial for individuals who wish to claim a tax treaty benefit or request exemption from certain taxes.

What are the types of form 8843 sample?

There are two main types of Form 8843 sample that you may encounter:

Form 8843 for individuals who are nonresident aliens for tax purposes.

Form 8843 for individuals who are dual-status aliens or resident aliens for part of the tax year.

How to complete form 8843 sample

Completing Form 8843 sample is a straightforward process. Here is a step-by-step guide to help you:

01

Gather all the necessary information, including your personal details, the number of days you were present in the United States, and any relevant tax treaty information if applicable.

02

Fill in sections A, B, C, and D of the form with accurate information.

03

Sign and date the form.

04

Submit the completed form to the appropriate tax authorities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out form 8843 sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What happens if F-1 student does not file taxes?

It's important to understand that filing tax returns is mandatory for international students, and not doing so by the deadline could result in problems with or a revocation of your visa as well as possible ineligibility for a green card.

Who needs to fill out 8843?

What is Form 8843? Form 8843 is not an income tax return. Form 8843 is merely an informational statement required by the U.S. government for certain nonresident aliens (including the spouses or dependents of nonresident aliens).

Can form 8843 be submitted online?

Our Form 8843 online wizard is only for international students on an F, J, M, or Q visa and their dependents, who are non-resident aliens for tax purposes.

What happens if I don't file form 8843?

There is no monetary penalty for failure to file Form 8843. However, in order to be compliant with federal regulations one must file Form 8843 if required to do so. (Remember, being compliant can affect the issuing of future US visas or granting of legal permanent resident status.)

What happens if I file 8843 late?

There is no monetary penalty for failure to file Form 8843. However, in order to be compliant with federal regulations one must file Form 8843 if required to do so. (Remember, being compliant can affect the issuing of future US visas or granting of legal permanent resident status.)

What happens if I file my taxes late international student?

The IRS expects you to file your taxes each year. Penalties for late filing may include fines, interest on taxes owed, or other consequences. Visit the IRS website for information on Filing Past Due Tax Returns. You can follow up with the IRS or a foreign tax expert if you have questions.