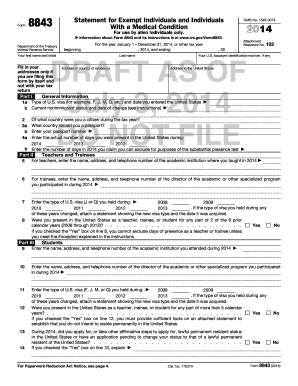

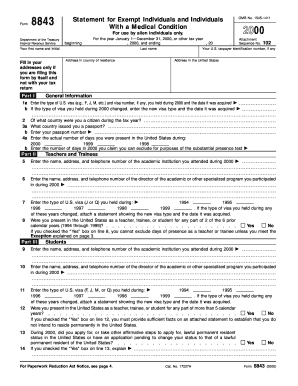

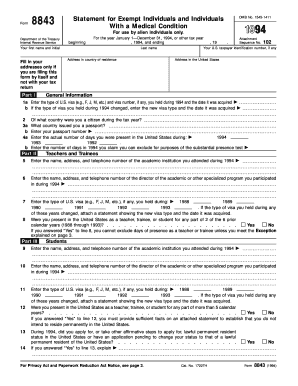

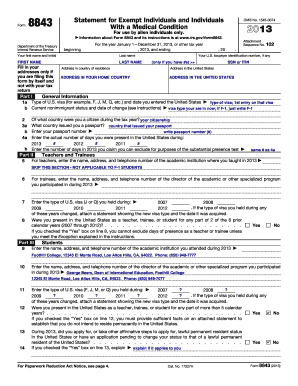

Form 8843 2017

What is form 8843 2017?

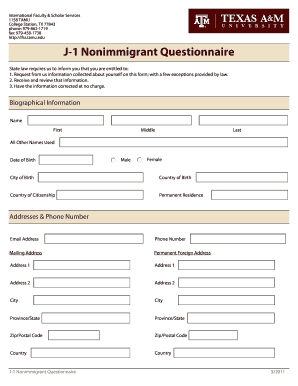

Form 8843 is a tax form used by non-resident aliens (including international students) to provide information about their days of presence in the United States. The form is specifically designed for individuals who are not eligible to claim closer connection exceptions or tax treaty benefits. By submitting form 8843, non-resident aliens fulfill their requirement of reporting their presence in the US to the Internal Revenue Service (IRS). It is important to note that the year 2017 refers to the tax year for which the form is applicable.

What are the types of form 8843 2017?

Form 8843 is available in two main types: individual and dependent. Individual form 8843 is used by non-resident aliens who are filing the form for themselves. On the other hand, dependent form 8843 is used by non-resident aliens who are claimed as dependents on someone else's tax return. Both types of form 8843 serve the purpose of reporting an individual's days of presence in the US as required by the IRS.

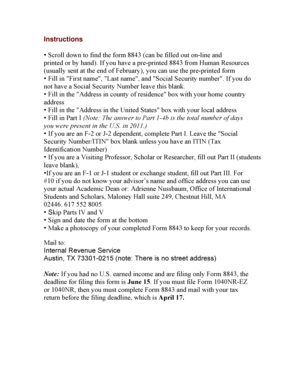

How to complete form 8843 2017?

Completing form 8843 is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.