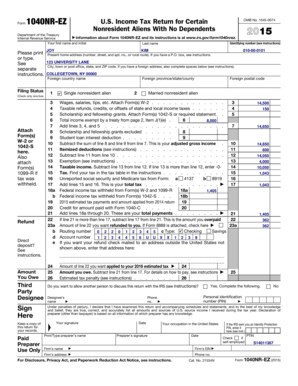

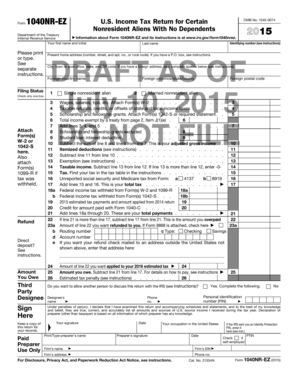

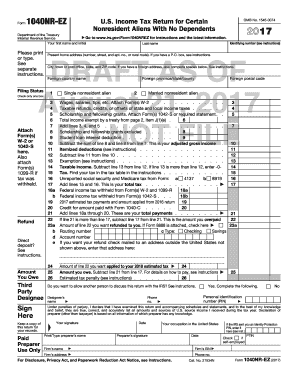

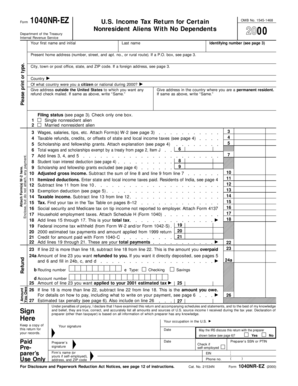

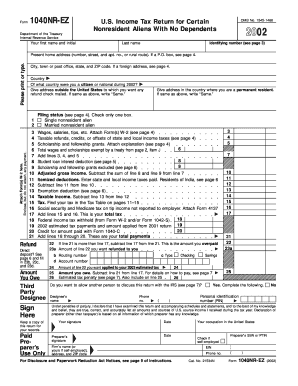

Form 1040nr-ez

What is form 1040nr-ez?

Form 1040nr-ez is a simplified version of the tax form for non-resident aliens who have no dependents and meet certain criteria. It is used to report income, deductions, and credits, and calculate the amount of tax owed or refunded.

What are the types of form 1040nr-ez?

There are several types of form 1040nr-ez, including:

Single or Married Filing Separately

Taxable income less than $100,000

No dependents

Income sources limited to wages, salaries, tips, taxable refunds, scholarships, or fellowship grants

How to complete form 1040nr-ez

Completing form 1040nr-ez is easy if you follow these steps:

01

Enter your personal information, such as name, address, and social security number

02

Report your income from all sources, including wages, salaries, and any other taxable income

03

Claim any applicable deductions and credits

04

Calculate the amount of tax owed or refunded using the provided tax tables or the IRS tax calculator

05

Sign and date the form before mailing it to the appropriate IRS address

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 1040nr-ez

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

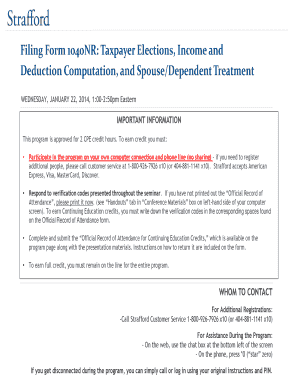

How do I change from 1040 to 1040NR?

Use Form 1040X to amend Form 1040NR or Form 1040NR-EZ. Also, use Form 1040X if you should have filed Form 1040, 1040A, or 1040EZ instead of Form 1040NR or 1040NR-EZ, or vice versa.

How do I get a 1040NR form?

Go to www.irs.gov/Form1040NR for instructions and the latest information.

How much does it cost to file 1040NR?

Average Fee for a U.S. Individual Tax Return (1040) or U.S. Nonresident Alien Income Tax Return (1040NR) with one State (return may include a few investment income and capital transactions): $400-$850 per year.

Can I Efile 1040NR-EZ?

The IRS does not allow electronic filing for Form 1040NR-EZ or Dual status returns. Those returns must be filed on paper.

What happens if you accidentally filed 1040 instead of form 1040NR 1040NR-EZ?

If you mistakenly filed a Form 1040, 1040A or 1040EZ and you need to file 1040NR or 1040NR-EZ, or vice versa, you will need to amend your return. Per the IRS Instructions for Form 1040X Amended U.S. Individual Income Tax Return, page 5: Resident and nonresident aliens.

Who should fill out 1040NR?

More In Forms and Instructions You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR. Represented an estate or trust that had to file Form 1040-NR.

Related templates