Homeowners Insurance Proposal Template - Page 2

What is Homeowners Insurance Proposal Template?

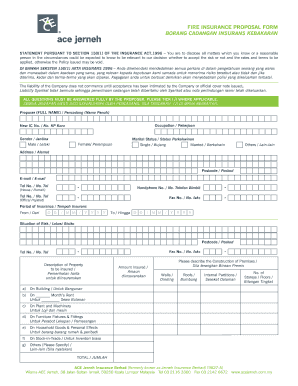

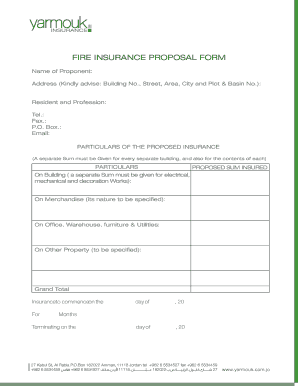

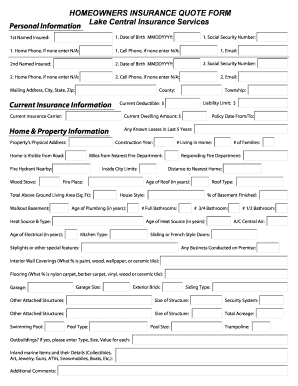

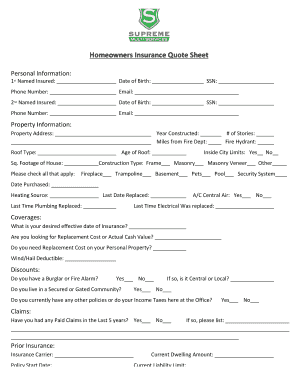

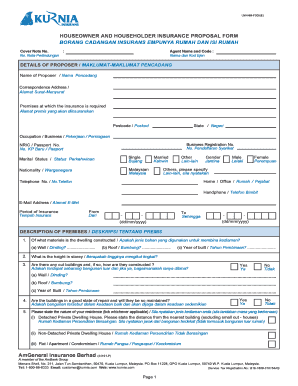

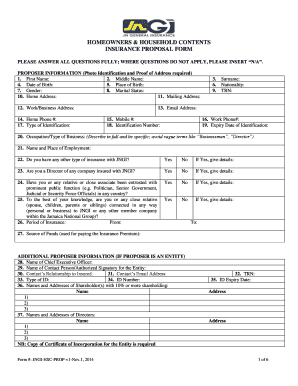

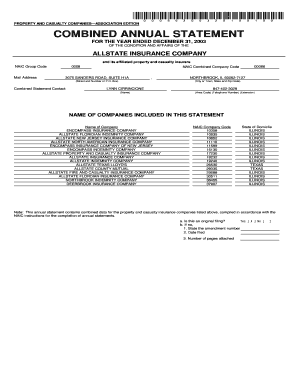

A Homeowners Insurance Proposal Template is a pre-designed document that provides a framework for creating a proposal for homeowners insurance. This template includes sections and fields that allow users to input relevant information about their property, coverage needs, and other details in order to generate a comprehensive proposal.

What are the types of Homeowners Insurance Proposal Template?

There are several types of Homeowners Insurance Proposal Templates available, each tailored to meet specific needs and requirements. Some common types include: 1. Basic Homeowners Insurance Proposal Template: This template offers a simple format for outlining the key components of a homeowners insurance proposal. 2. Comprehensive Homeowners Insurance Proposal Template: This template provides a more detailed and comprehensive structure for a homeowners insurance proposal, including additional sections and fields to cover specific aspects of the property and coverage needs. 3. Customizable Homeowners Insurance Proposal Template: This template allows users to customize and tailor the proposal according to their unique requirements, offering flexibility in terms of design and content.

How to complete Homeowners Insurance Proposal Template

Completing a Homeowners Insurance Proposal Template is a simple process that can be accomplished by following these steps: 1. Begin by filling out the basic details of the property, such as the address, type of property (house, apartment, etc.), and the estimated value. 2. Specify the desired coverage options, such as fire, theft, flood, and liability insurance. 3. Provide any additional information or specific requirements related to the property or coverage needs. 4. Review the completed proposal to ensure all the necessary information is included and accurate. 5. Save the proposal and share it with the relevant parties, such as insurance agents or potential insurers.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.