What is Indemnity Agreement Template?

An Indemnity Agreement Template is a legally binding document that outlines the terms and conditions under which one party agrees to indemnify, or compensate, another party for any damages, losses, or expenses incurred as a result of a particular event or action. It is used to protect the interests of both parties involved by clearly defining their rights and responsibilities in case of any unforeseen circumstances or legal issues.

What are the types of Indemnity Agreement Template?

There are several types of Indemnity Agreement Templates available, each catering to different scenarios and industries. Some common types include:

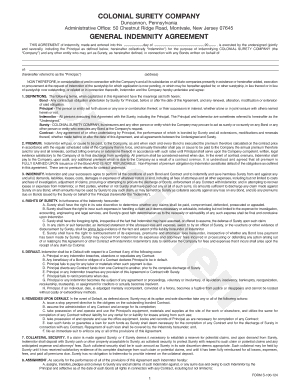

General Indemnity Agreement: This type of agreement provides broad protection to one party from all possible claims or losses that may arise from a specific event or transaction.

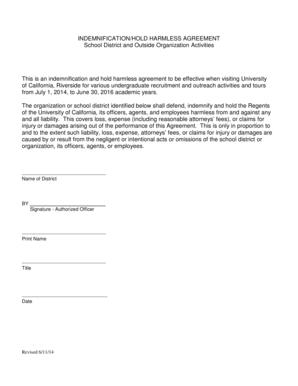

Specific Indemnity Agreement: This type of agreement focuses on indemnifying one party for specific risks or liabilities associated with a particular situation or agreement.

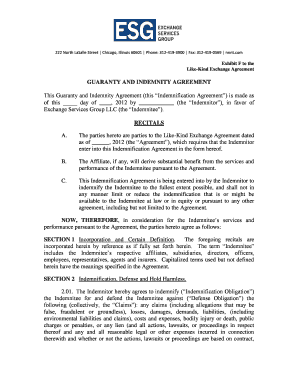

Mutual Indemnity Agreement: This type of agreement involves both parties mutually agreeing to indemnify each other for any losses or damages incurred during the course of their business relationship.

How to complete Indemnity Agreement Template

Completing an Indemnity Agreement Template involves the following steps:

01

Begin by downloading a customizable Indemnity Agreement Template from a reliable source.

02

Carefully read through the template and understand all the terms and conditions mentioned.

03

Modify the template according to your specific needs by adding or removing clauses, and customizing the language to match the intended agreement.

04

Clearly specify the parties involved, their contact details, and any relevant background information.

05

Define the scope and limitations of the indemnification, including the specific risks or liabilities covered.

06

Clearly state the payment terms, if any, for the indemnification.

07

Review the completed agreement with all parties involved to ensure that everyone understands and agrees to the terms.

08

Sign the agreement, preferably in the presence of a legal professional or notary public, to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.