Insurance Agency Proposal Template - Page 2

What is Insurance Agency Proposal Template?

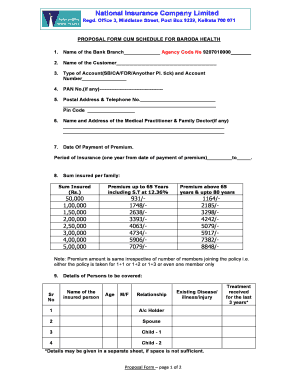

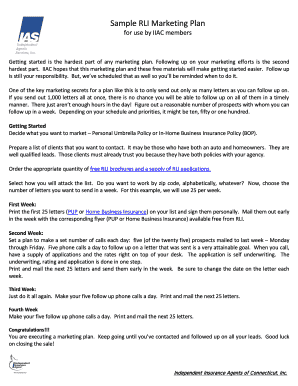

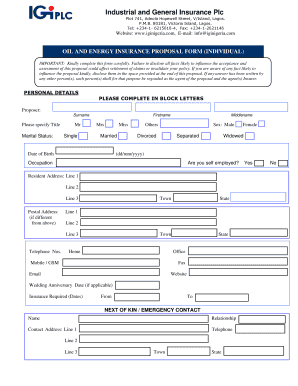

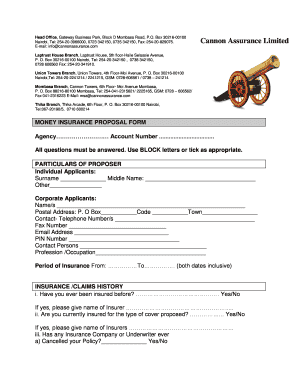

An Insurance Agency Proposal Template is a pre-designed document that outlines the details of an insurance agency's proposal to potential clients. It provides a structured format for presenting key information such as services offered, pricing, terms and conditions, and client testimonials. The template helps insurance agencies save time and effort by providing a ready-made framework that can be customized to suit individual client requirements.

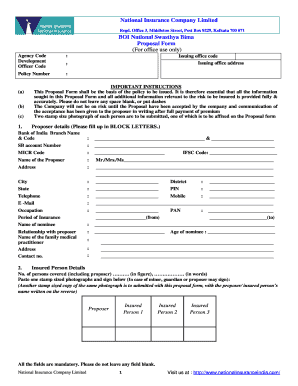

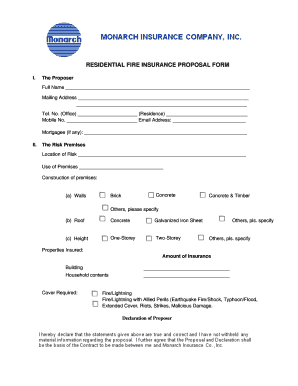

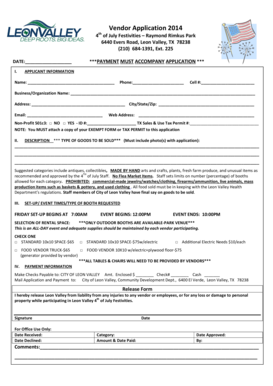

What are the types of Insurance Agency Proposal Template?

There are various types of Insurance Agency Proposal Templates available, each catering to different insurance products and services. Some common types include:

How to complete Insurance Agency Proposal Template

Completing an Insurance Agency Proposal Template is a straightforward process. Follow these steps to create a compelling proposal:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.