Insurance Claim Letter Sample

What is insurance claim letter sample?

An insurance claim letter sample is a document written by an individual to their insurance company, requesting coverage for a claim. This letter outlines the details of the claim, including the incident, the amount being claimed, and any supporting documentation.

What are the types of insurance claim letter samples?

There are several types of insurance claim letter samples, including:

Auto insurance claim letter sample

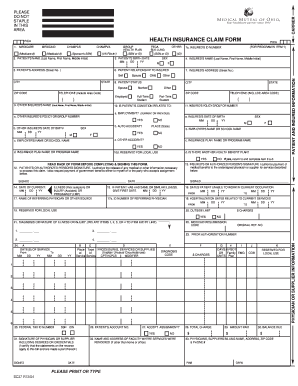

Health insurance claim letter sample

Property insurance claim letter sample

Life insurance claim letter sample

How to complete insurance claim letter sample

Completing an insurance claim letter sample is a straightforward process. Here are some steps to help you:

01

Gather all necessary information about the incident and the claim

02

Include details such as policy number, date of incident, and amount claimed

03

Provide any relevant supporting documents, such as photos or receipts

04

Clearly state the reason for the claim and the desired outcome

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out insurance claim letter sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a claim format?

noun. (Insurance: Claims) A claim form is a standard printed document used for submitting a claim. Under normal circumstances, reimbursement will take place within ten days of receipt and approval of claim form and all required documents.

What are the qualities of a good claim?

Effective claims have three qualities: They address important, relevant problems. Readers will think that the claim might help them address a problem they care about. They are contestable. That is, readers will wonder whether the claim is true. They are debatable.

How do you write a claim step by step?

There are six steps in making a claim. Step 1: Contact Your Agent Immediately. Step 2: Carefully Document Your Losses. Step 3: Protect Your Property from Further Damage or Theft. Step 4: Working With the Adjuster. Step 5: Settling Your Claim. Step 6: Repairing Your Home.

How do you write a good claim letter?

Each type has unique elements, but all good claim letters share some common qualities as well. They should be written clearly, get to the point quickly, use a firm but not antagonistic tone, explicitly state your demand, and be free of mistakes and typos.

What makes a good claim letter?

Most business professionals and scholars agree that a basic claim letter should include four core elements: a clear explanation of the complaint, an explanation of what strife this has caused or the losses suffered because of it, an appeal to honesty and fairness, and a statement of what you would consider a fair

What are the two types of claim letter?

Claim Letters can be of the following types: Claim Letter for Damaged Goods. Insurance Claim Letter.