Michigan Land Contract Purchase Agreement

What is michigan land contract purchase agreement?

A Michigan land contract purchase agreement is a legally binding contract used in real estate transactions. It allows a buyer to purchase a property by making installment payments directly to the seller, instead of obtaining traditional financing from a bank or other mortgage lender. This type of agreement is commonly used when the buyer does not have access to traditional financing options or when the seller is willing to provide seller financing.

What are the types of michigan land contract purchase agreement?

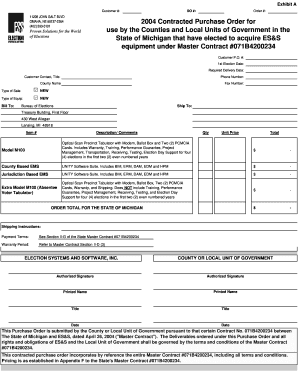

There are two main types of Michigan land contract purchase agreements: 1. Full Payment Land Contract: In this type of agreement, the buyer agrees to make regular payments to the seller until the full purchase price is paid off. Once the payment is complete, the seller transfers the property ownership to the buyer. 2. Partial Payment Land Contract: This type of agreement involves the buyer making regular payments to the seller, just like in a full payment contract. However, the buyer does not need to pay the full purchase price. Instead, there is a balloon payment due at a later date, which acts as the final payment. Once the balloon payment is made, the seller transfers the property ownership to the buyer.

How to complete michigan land contract purchase agreement

Completing a Michigan land contract purchase agreement involves several steps. Here is a brief guide to help you through the process: 1. Obtain a Michigan land contract form: You can either consult an attorney to draft a customized agreement or use an online platform like pdfFiller to access ready-to-use templates. 2. Provide property details: Fill in the necessary information about the property being sold, including the address, legal description, and any specific terms or conditions. 3. Specify buyer and seller details: Include the full names and contact information of both the buyer and seller. 4. Set the purchase price and payment terms: Define the total purchase price and the payment schedule, including the amount of down payment, interest rate (if applicable), and installment periods. 5. Include default and termination clauses: Outline the consequences for defaulting on payments or breaching the agreement, as well as the conditions for termination. 6. Sign and notarize the agreement: Both parties should sign the agreement in the presence of a notary public to ensure its legality and enforceability. Remember, it's always advisable to consult with a real estate attorney or a knowledgeable professional to guide you through the process and ensure you comply with all legal requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.