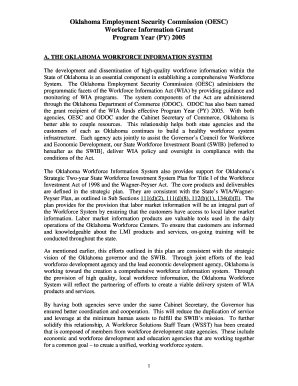

What is net worth statement format individual?

A net worth statement format for individuals is a financial document that provides a snapshot of an individual's financial situation. It summarizes the individual's assets, such as cash, investments, real estate, and personal property, as well as their liabilities, such as debts and obligations. By calculating the difference between the total assets and liabilities, the net worth can be determined. This format is commonly used to assess an individual's financial health and track their progress over time.

What are the types of net worth statement format individual?

There are several types of net worth statement formats for individuals, each catering to different financial circumstances. Some common types include:

Basic Net Worth Statement: This format includes the most essential elements of an individual's financial situation, such as cash, investments, and debts.

Comprehensive Net Worth Statement: This format provides a detailed overview of an individual's financial situation, including all assets, liabilities, and additional details like insurance policies, retirement accounts, and business interests.

Tax Net Worth Statement: This format is specifically designed to capture the information required for tax purposes, including income, deductions, and tax liabilities.

Retirement Net Worth Statement: This format focuses on an individual's retirement savings and investments, estimating their future retirement income based on their current financial situation.

How to complete net worth statement format individual

Completing a net worth statement format for individuals can be a straightforward process if you follow these steps:

01

Gather all relevant financial documents, including bank statements, investment statements, mortgage or loan documents, and credit card statements.

02

List all your assets, such as cash, savings, investments, retirement accounts, real estate properties, vehicles, and personal valuables. Assign each asset a corresponding value based on fair market prices.

03

Identify your liabilities, including mortgages, loans, credit card debts, and any other outstanding financial obligations. Note the exact amount owed for each liability.

04

Calculate your net worth by subtracting your total liabilities from your total assets. This will give you an indication of your overall financial position.

05

Review and update your net worth statement regularly to track your financial progress and make any necessary adjustments.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.