What is Monthly Budget Worksheet Template?

A Monthly Budget Worksheet Template is a tool that helps individuals or businesses track and manage their finances on a monthly basis. It provides a structured layout for organizing income, expenses, savings goals, and other financial information. By using this template, users can gain better visibility into their financial situation and make informed decisions about their spending and saving habits.

What are the types of Monthly Budget Worksheet Template?

There are several types of Monthly Budget Worksheet Templates available, catering to different needs and preferences. Some common types include:

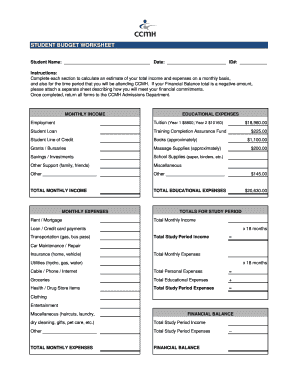

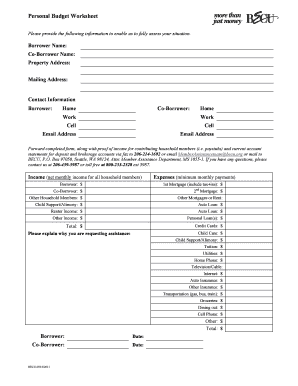

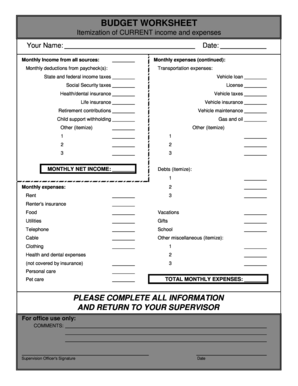

Basic Monthly Budget Worksheet: This template includes essential categories for income, expenses, and savings.

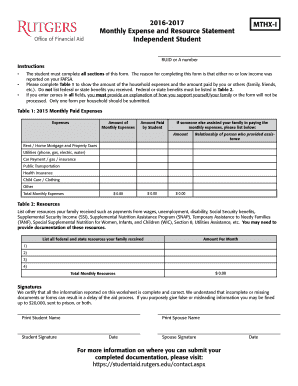

Detailed Monthly Budget Worksheet: This template provides more detailed sections for various expense categories, allowing users to have a comprehensive view of their financial situation.

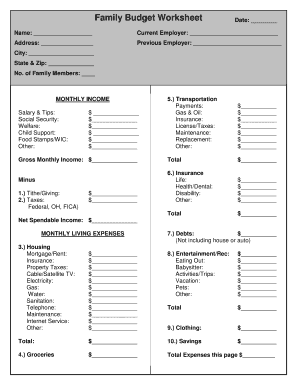

Family Monthly Budget Worksheet: Designed for households, this template includes sections for tracking expenses related to family members, such as education, childcare, and healthcare.

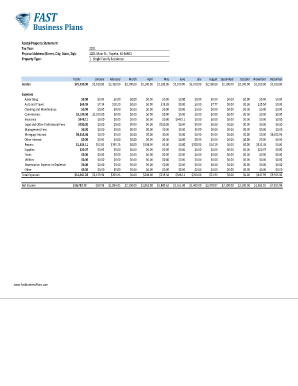

Business Monthly Budget Worksheet: Tailored for businesses, this template helps track income and expenses specific to business operations.

Personal Finance Monthly Budget Worksheet: This template focuses on personal finances, providing sections to track income, expenses, debt payments, and savings goals.

How to complete Monthly Budget Worksheet Template

Completing a Monthly Budget Worksheet Template is a straightforward process. Follow these steps:

01

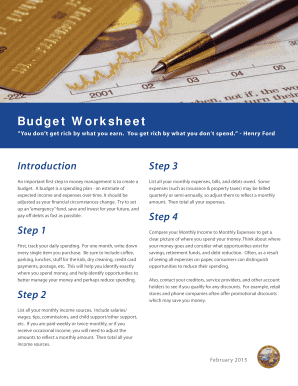

Gather financial information: Collect all relevant documents, such as bank statements, bills, and income records.

02

Identify income sources: List down all sources of income, including salaries, investments, and rental income.

03

Track expenses: Categorize and record all expenses, such as housing, transportation, food, entertainment, and debt payments.

04

Set saving goals: Determine the amount you want to save each month and allocate it in the budget worksheet.

05

Review and adjust: Regularly review your budget worksheet, identify areas for improvement or adjustment, and make necessary changes to your spending habits.

06

Utilize online platforms like pdfFiller: Empower yourself with tools like pdfFiller to create, edit, and share documents online, including Monthly Budget Worksheet Templates. With pdfFiller's unlimited fillable templates and powerful editing features, you can efficiently manage your finances and stay on top of your budgeting goals.

Taking control of your finances and staying on top of your budget is crucial for achieving financial stability and meeting your goals. By using a Monthly Budget Worksheet Template and following the steps mentioned above, you can effectively track your income, expenses, and savings, and make informed financial decisions. Remember, pdfFiller is here to support you in streamlining your document management process and empowering you to achieve financial success.