What is Monthly Household Budget?

A monthly household budget is a financial plan that helps individuals or families manage their income and expenses on a monthly basis. It provides a clear picture of where the money is coming from and where it is being spent. By creating and following a monthly household budget, individuals can gain control over their finances and make informed decisions about their spending and saving habits.

What are the types of Monthly Household Budget?

There are various types of monthly household budgets that individuals can choose from based on their specific financial goals and circumstances. Some common types include:

Basic Budget: This type focuses on covering essential expenses like rent/mortgage, utilities, groceries, and transportation.

Savings Budget: This type emphasizes saving a specific portion of the income for future goals like buying a house, creating an emergency fund, or funding retirement.

Debt Repayment Budget: This type is designed to allocate a significant portion of the income towards paying off existing debts, such as credit card debts, loans, or student loans.

Flexible Budget: This type allows for more flexibility in spending by allocating funds to different categories based on priorities and adjusting as needed.

Zero-Based Budget: This type requires allocating every dollar of income towards specific expenses, savings, or debt payments to ensure complete control over the money.

Cash Envelope Budget: This type involves using physical cash and dividing it into envelopes labeled with different expense categories, helping individuals track their spending and control expenses.

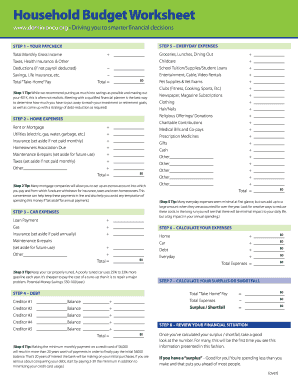

How to complete Monthly Household Budget

Completing a monthly household budget is a straightforward process that involves a few simple steps. Here's how to do it:

01

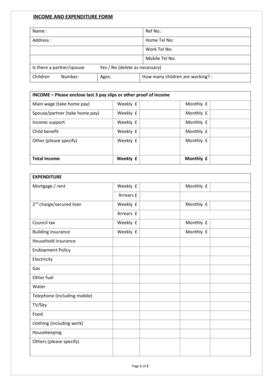

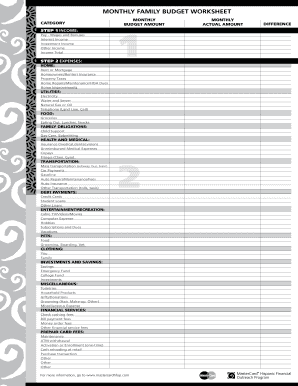

Calculate your total monthly income: Add up all the sources of income you receive in a month, including salaries, side gigs, rental income, or any other regular income streams.

02

Track your expenses: Keep track of all your expenses for a month. Categorize them into essential expenses (e.g., rent, utilities, groceries) and non-essential expenses (e.g., entertainment, dining out).

03

Set financial goals: Determine your financial goals, such as saving a specific amount or paying off debts, and prioritize them.

04

Allocate your income: Allocate your income to different expense categories based on your priorities. Ensure that essential expenses are covered first, followed by savings and debt payments.

05

Monitor and adjust: Regularly monitor your budget and make adjustments as needed. Keep track of your expenses and compare them with your budget to identify areas of improvement.

06

Utilize online tools: Consider using online budgeting tools or apps to streamline the budgeting process and get a better overview of your financial situation.

By following these steps, individuals can successfully complete their monthly household budget and take control of their finances. Remember, pdfFiller offers unlimited fillable templates and powerful editing tools to make the process even easier and more efficient.