What is mortgage forbearance agreement sample?

A mortgage forbearance agreement sample is a legal document that outlines an agreement between a borrower and a lender regarding temporary relief from mortgage payments. This agreement allows the borrower to temporarily suspend or reduce their mortgage payments for a specific period of time due to financial hardship or other qualifying reasons. The agreement specifies the terms and conditions of the forbearance, including the duration of the relief period and any applicable fees or interest.

What are the types of mortgage forbearance agreement sample?

There are several types of mortgage forbearance agreement samples available, depending on the specific needs and circumstances of the borrower. Some common types include:

COVID-19 Forbearance: This type of forbearance agreement was introduced to address the financial hardships caused by the COVID-19 pandemic.

Natural Disaster Forbearance: This type of forbearance agreement is designed for borrowers who have been affected by natural disasters, such as hurricanes, earthquakes, or wildfires.

Temporary Financial Hardship Forbearance: This type of forbearance agreement provides relief to borrowers who are facing temporary financial difficulties, such as loss of employment or unexpected medical expenses.

Dependent Forbearance: This type of forbearance agreement is applicable when the borrower has dependent children who are experiencing extraordinary financial circumstances.

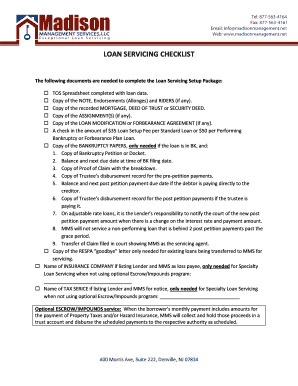

How to complete mortgage forbearance agreement sample

Completing a mortgage forbearance agreement sample involves several steps. Here is a simple guide to help you through the process:

01

Gather necessary information - Collect all the required information, such as your loan details, financial documents, and personal information.

02

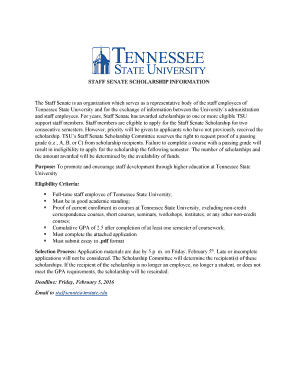

Download a mortgage forbearance agreement sample - Look for a reliable source to download a mortgage forbearance agreement sample.

03

Fill out the agreement - Use a reputable online document editor, such as pdfFiller, to fill out the agreement with the required information.

04

Review and revise - Carefully review the completed agreement to ensure accuracy and make any necessary revisions.

05

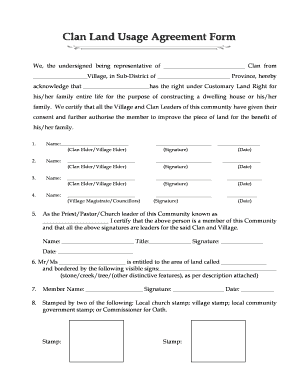

Obtain signatures - Sign the agreement, and if required, have it signed by the lender or any other relevant parties.

06

Keep a copy - Make sure to keep a copy of the completed and signed agreement for your records.

pdfFiller, a leading online document management platform, offers users the ability to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ideal solution for completing your mortgage forbearance agreement sample with ease and efficiency.