Mortgage Forbearance Requirements

What is mortgage forbearance requirements?

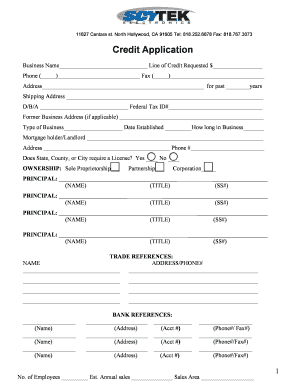

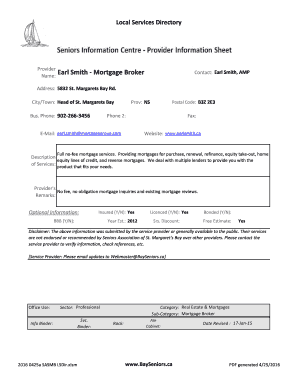

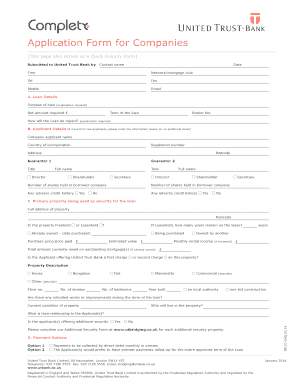

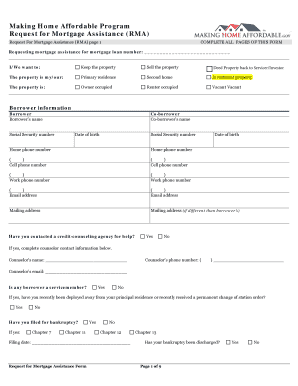

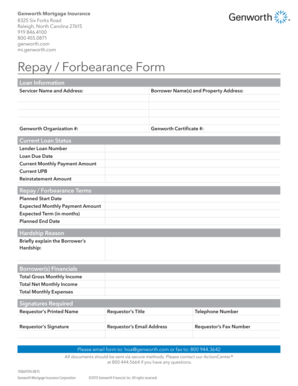

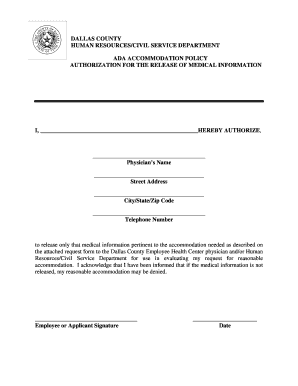

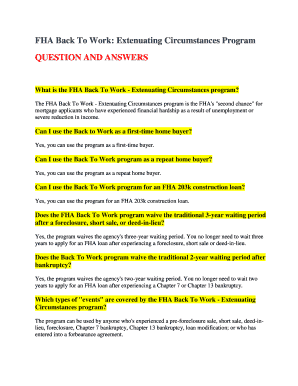

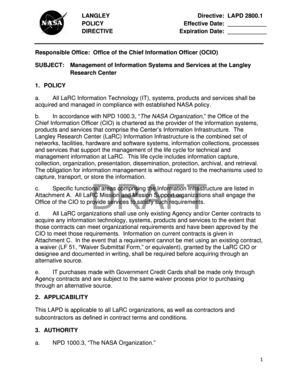

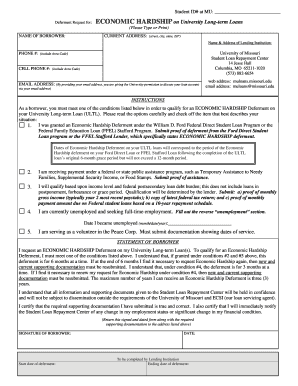

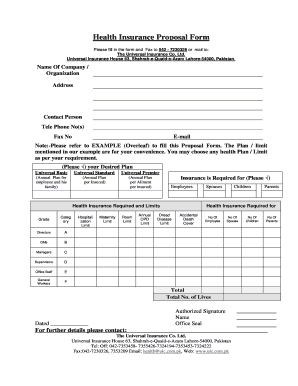

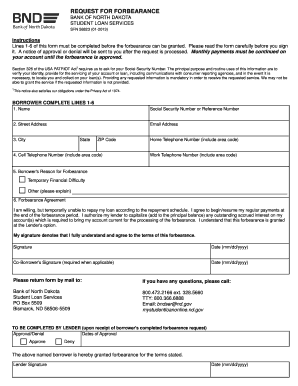

Mortgage forbearance requirements refer to the conditions that borrowers must meet in order to qualify for a temporary pause or reduction in their mortgage payments. These requirements vary depending on the mortgage lender, but commonly include demonstrating financial hardship, providing supporting documentation, and submitting a forbearance request in a timely manner.

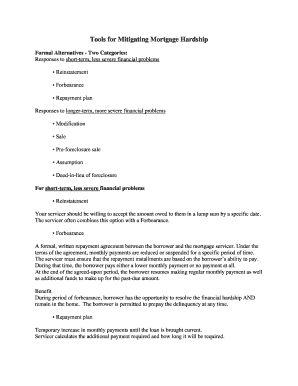

What are the types of mortgage forbearance requirements?

There are several types of mortgage forbearance requirements that borrowers should be aware of:

How to complete mortgage forbearance requirements

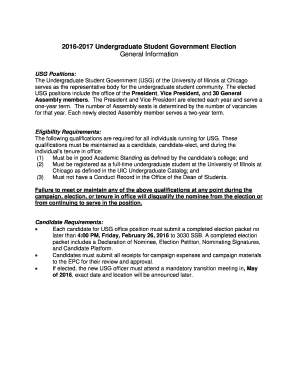

Completing mortgage forbearance requirements may seem daunting, but it can be done with the following steps:

By following these steps, you can successfully complete the mortgage forbearance requirements and potentially secure temporary relief from your mortgage payments. Remember, each lender may have their own unique set of requirements, so it's important to stay in communication with them throughout the process.