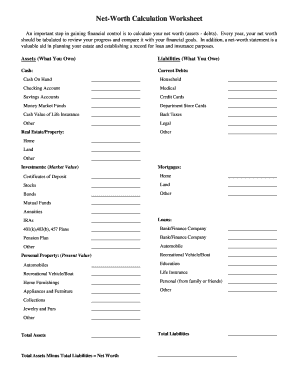

What is Net Worth Worksheet?

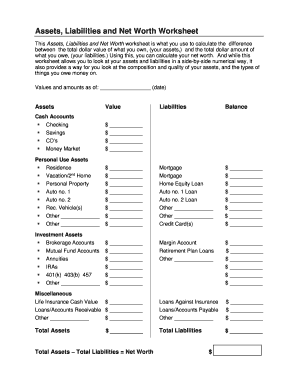

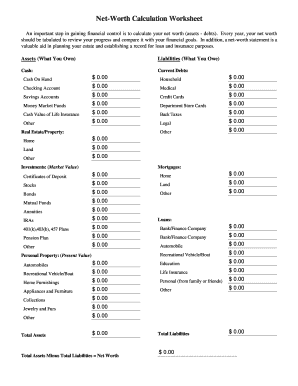

A Net Worth Worksheet is a financial tool that helps individuals or businesses calculate their net worth. Net worth is the difference between a person's assets and liabilities, and it provides a snapshot of their financial health. The worksheet typically includes categories such as cash, investments, real estate, debts, and other valuable assets. By filling out a Net Worth Worksheet, users can track their financial progress over time and make informed decisions about their financial goals.

What are the types of Net Worth Worksheet?

There are several types of Net Worth Worksheets available, depending on the specific needs and preferences of the user. Some common types include:

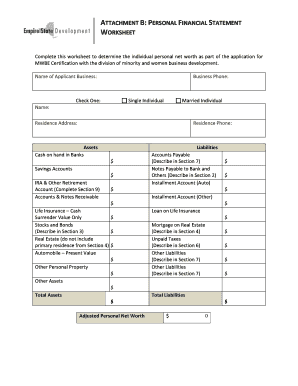

Basic Net Worth Worksheet: This type of worksheet includes essential categories such as assets, liabilities, and net worth. It is suitable for individuals or businesses who want a straightforward calculation.

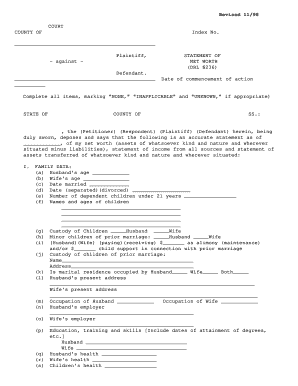

Detailed Net Worth Worksheet: This type of worksheet provides more comprehensive categories and allows users to input detailed information about each asset and liability. It is helpful for individuals or businesses with complex financial situations.

Retirement Net Worth Worksheet: This type of worksheet focuses on assets and liabilities related to retirement planning. It helps users assess their preparedness for retirement and make necessary adjustments to achieve their retirement goals.

Real Estate Net Worth Worksheet: This type of worksheet specifically tracks real estate assets and liabilities. It is suitable for individuals or businesses with significant investments in real estate.

Business Net Worth Worksheet: This type of worksheet is tailored for businesses to assess their financial position by considering business-related assets, liabilities, and net worth.

How to complete Net Worth Worksheet

Completing a Net Worth Worksheet is a straightforward process. Here are the steps to follow:

01

Gather all relevant financial documents, including bank statements, investment statements, property valuations, and loan statements.

02

Identify and list all your assets, such as cash, bank accounts, investments, real estate, vehicles, and valuable personal belongings. Assign a monetary value to each asset based on its current market worth.

03

Identify and list all your liabilities, such as mortgages, loans, credit card debts, and other outstanding debts. Note down the outstanding balances for each liability.

04

Calculate the total value of your assets and the total value of your liabilities.

05

Subtract the total value of your liabilities from the total value of your assets to obtain your net worth.

06

Record your net worth and review the results. Consider taking steps to improve your net worth by increasing your assets or reducing your liabilities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.