Asset Worksheet Estate Planning

What is asset worksheet estate planning?

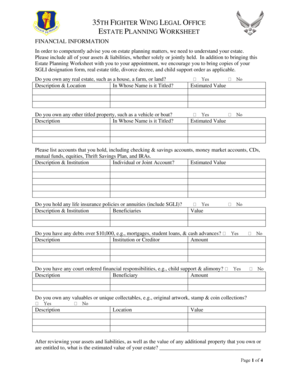

Asset worksheet estate planning is a tool used to organize and manage one's assets in the event of incapacity or death. It provides an overview of all the assets owned by an individual, including properties, investments, bank accounts, and personal belongings.

What are the types of asset worksheet estate planning?

There are different types of asset worksheet estate planning, tailored to various needs and preferences. Some common types include: - Basic asset worksheet: It includes essential information about assets and is suitable for individuals with uncomplicated estates. - Detailed asset worksheet: This type provides in-depth information about assets, including their values, beneficiaries, and any outstanding debts. - Digital asset worksheet: Designed to capture information about online accounts, cryptocurrencies, and other digital assets.

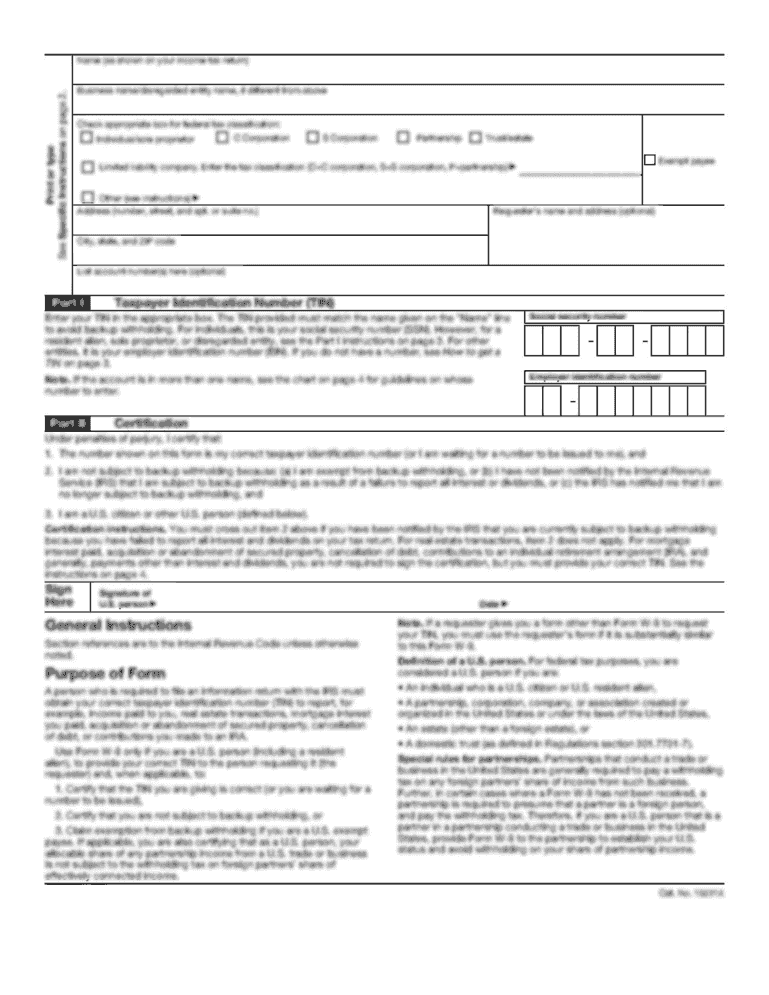

How to complete asset worksheet estate planning

Completing an asset worksheet for estate planning can be made easier with the help of online tools like pdfFiller. Here are the steps to follow: 1. Gather all necessary documents: Collect details about your assets, such as property deeds, investment statements, bank account information, insurance policies, and any outstanding loans or debts. 2. Organize the information: Categorize your assets and create sections in the worksheet for each category, such as real estate, financial accounts, personal belongings, and digital assets. 3. Fill in the details: Enter the required information in the worksheet, including asset descriptions, current values, ownership details, and beneficiary designation. 4. Review and update regularly: It's important to regularly review and update your asset worksheet to reflect any changes in your asset portfolio or personal circumstances. By using pdfFiller, you can easily create, edit, and share your asset worksheet online and ensure it remains up-to-date.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.