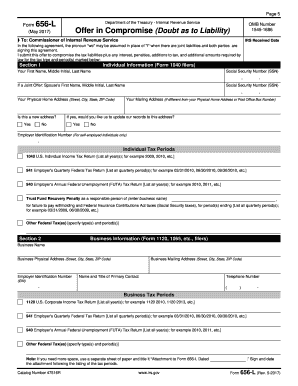

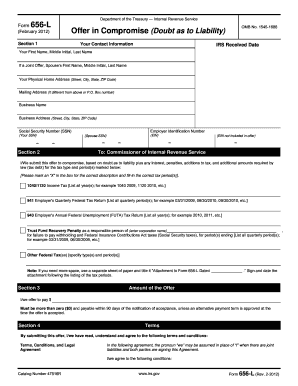

656-L Form

What is 656-L Form?

The 656-L Form is a document used by taxpayers to request an offer in compromise (OIC) with the Internal Revenue Service (IRS). It is specifically designed for individuals or businesses who are unable to pay their tax liabilities in full. The purpose of the form is to provide detailed financial information and propose a suitable repayment amount to settle their tax debt. By submitting the 656-L Form, taxpayers can explore alternatives to full payment and potentially reduce their tax burden. It plays a vital role in assisting taxpayers in resolving their outstanding tax debts with the IRS.

What are the types of 656-L Form?

The 656-L Form comes in two types depending on the tax liability involved: 1. Form 656-L (Individual): This form is used by individual taxpayers to apply for an offer in compromise with the IRS for their personal tax liability. 2. Form 656-L (Business): This form is specifically designed for businesses seeking an offer in compromise with the IRS for their business-related tax liabilities.

How to complete 656-L Form

Completing the 656-L Form is a detailed process that requires providing accurate financial information. Here are the steps to complete the form: 1. Personal/Business Information: Enter your personal or business details, including name, address, and taxpayer identification number (TIN). 2. Tax Liability Details: Specify your outstanding tax liabilities, including the tax periods and amounts owed. 3. Monthly Income and Expenses: Provide your monthly income and expense details, including wages, dividends, rent, utilities, and other relevant information. 4. Asset and Liability Information: Disclose your assets and liabilities, such as real estate, vehicles, bank accounts, and outstanding loans. 5. Offer Amount: Determine the offer amount you are proposing to settle your tax debt with the IRS. 6. Certification and Signatures: Sign and certify the form, acknowledging the accuracy of the provided information.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. With pdfFiller's user-friendly interface and comprehensive features, users can easily complete the 656-L Form and other important documents efficiently and accurately.