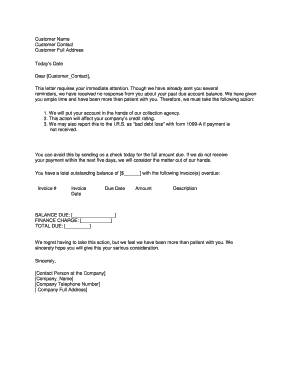

Past Due Reminder Letter

What is Past Due Reminder Letter?

A Past Due Reminder Letter is a document sent to remind someone about an overdue payment or an outstanding debt. It serves as a gentle reminder to the recipient that they have not yet fulfilled their financial obligations and encourages them to make the necessary payment as soon as possible.

What are the types of Past Due Reminder Letter?

There are several types of Past Due Reminder Letters, including: 1. Initial Reminder Letter: Sent shortly after the payment due date to remind the recipient about the outstanding amount. 2. Second Reminder Letter: Sent after the initial reminder letter if the payment is still not received. 3. Final Reminder Letter: Sent as a last attempt to collect the payment before taking further action, such as sending the account to collections or taking legal actions.

How to complete Past Due Reminder Letter

To complete a Past Due Reminder Letter, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.