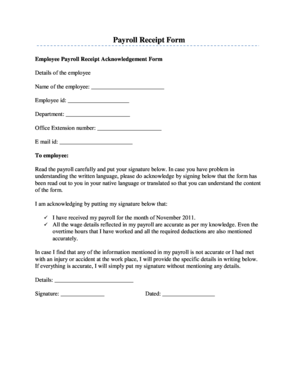

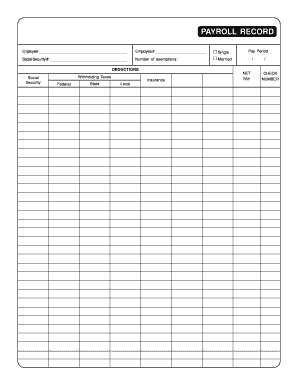

What are Payroll Templates?

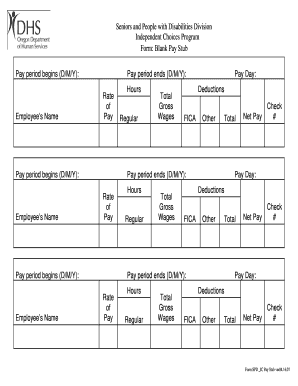

Payroll templates are predefined formats that businesses use to organize and streamline their payroll processes. These templates typically include sections for employee details, pay rates, hours worked, deductions, and other relevant information. By using payroll templates, businesses can ensure accuracy and consistency in their payroll calculations.

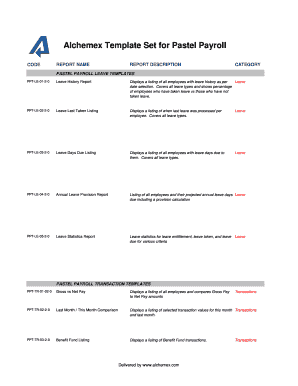

What are the types of Payroll Templates?

There are several types of payroll templates that businesses can choose from based on their specific needs. Some common types include:

Basic payroll template - includes essential fields for employee wages, hours, and deductions.

Salary payroll template - focuses on monthly or annual salary calculations for employees.

Hourly payroll template - designed for tracking and calculating hourly wages and overtime pay.

Commission payroll template - used for employees who earn commission-based income.

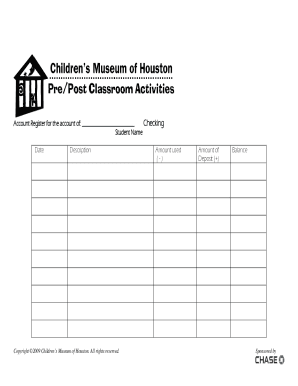

Self-employed payroll template - tailored for independent contractors or freelancers who need to track their income and expenses.

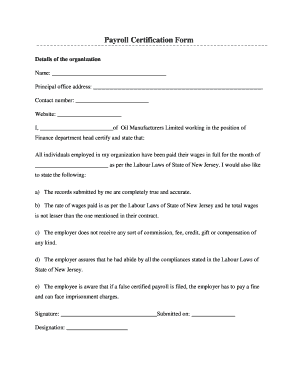

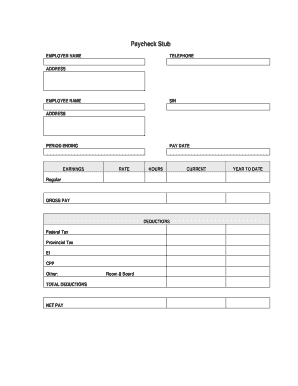

How to complete Payroll Templates

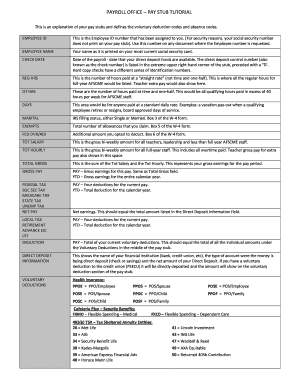

Completing payroll templates is a straightforward process that involves the following steps:

01

Input employee details - enter the name, address, tax ID, and other relevant information for each employee.

02

Enter wage and hour information - input the pay rate, hours worked, overtime hours, and any other relevant wage details.

03

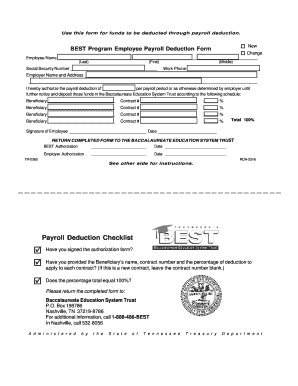

Calculate deductions and benefits - include deductions such as taxes, insurance, and retirement contributions, as well as any employee benefits.

04

Review and verify information - double-check all entries for accuracy and ensure that all calculations are correct.

05

Save and share the completed template - once satisfied with the data entered, save the template and share it with the appropriate stakeholders.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.