Personal Budget App

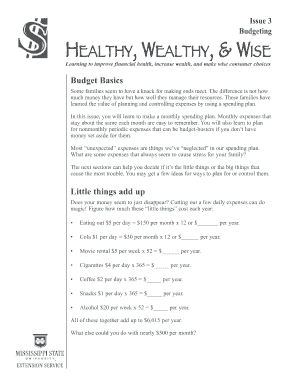

What is personal budget app?

A personal budget app is a digital tool that helps individuals keep track of their finances and manage their expenses effectively. It allows users to monitor their income, expenses, savings, and investments in one place, providing a comprehensive overview of their financial situation. With a personal budget app, users can set financial goals, create budgets, categorize expenses, and track their progress towards their financial objectives. This convenient and user-friendly app makes budgeting easier and more accessible, helping individuals take control of their money and make informed financial decisions.

What are the types of personal budget app?

There are several types of personal budget apps available to cater to different financial needs and preferences: 1. Expense tracking apps: These apps focus on recording and categorizing expenses, allowing users to see where their money is going. 2. Budgeting apps: These apps help users create and manage budgets, providing insights into spending habits and helping to plan for future expenses. 3. Investment tracking apps: These apps allow users to monitor their investment portfolio and track the performance of stocks, bonds, and other financial assets. 4. Saving apps: These apps focus on helping individuals save money by setting goals, automating savings, and providing tips and strategies to reach those goals. 5. Debt management apps: These apps assist users in managing their debt by tracking payments, reminding them of due dates, and offering strategies to pay off debt faster.

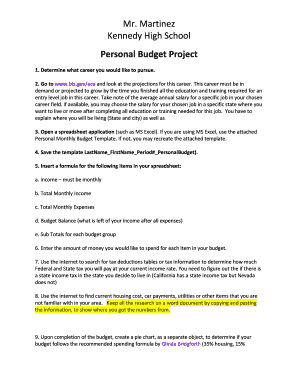

How to complete personal budget app

Completing a personal budget app is a straightforward process that can be done in a few simple steps: 1. Download and install a personal budget app from a trusted app store. 2. Create an account by providing the necessary information, such as your name, email address, and password. 3. Set your financial goals by identifying what you want to achieve with your budgeting efforts, such as saving for a vacation or paying off debt. 4. Connect your bank accounts and credit cards to the app to automatically import your financial transactions. 5. Categorize your expenses by assigning them to specific budget categories, such as groceries, transportation, or entertainment. 6. Set up a budget by allocating amounts to each budget category based on your financial goals and priorities. 7. Track your expenses regularly by entering them manually or allowing the app to import them automatically. 8. Monitor your progress and make adjustments to your budget as needed. 9. Take advantage of additional features offered by the app, such as financial reports, bill reminders, and savings tips. By following these steps, you can effectively complete your personal budget app setup and start managing your finances efficiently.

pdfFiller is a reliable and user-friendly platform that provides all the necessary tools to manage your documents effectively. With its extensive features and intuitive interface, it's the perfect choice for streamlining your document workflow.