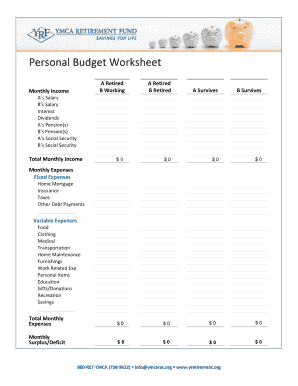

Personal Budget Worksheet Pdf

What is personal budget worksheet pdf?

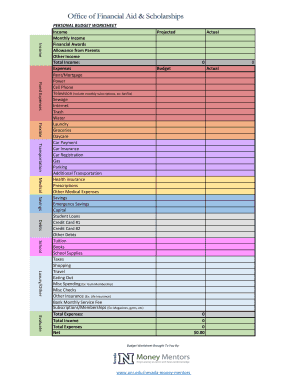

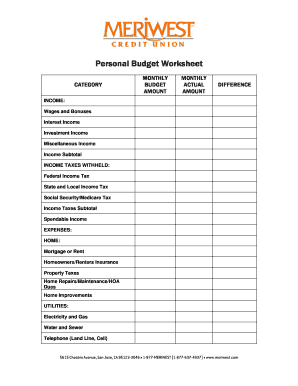

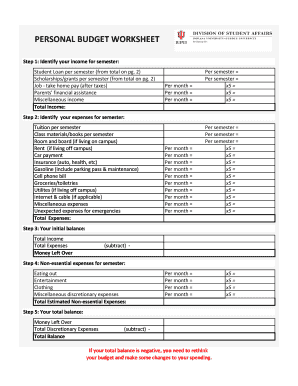

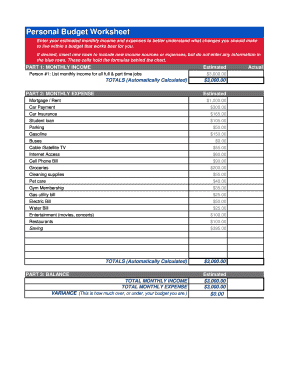

A personal budget worksheet PDF is a digital document that helps individuals track and manage their personal finances. It provides a comprehensive overview of income, expenses, and savings. By using a personal budget worksheet PDF, users can gain a clear understanding of their financial situation and make informed decisions about their money.

What are the types of personal budget worksheet pdf?

There are several types of personal budget worksheet PDFs available, each designed to suit different needs and preferences. Some common types include: 1. Basic Budget Worksheet: This type of worksheet includes categories for income, expenses, and savings, allowing users to track their overall financial health. 2. Monthly Budget Worksheet: As the name suggests, this worksheet focuses on monthly income and expenses, helping users plan and allocate their funds more effectively. 3. Debt Repayment Worksheet: This type of worksheet is specifically designed for people who want to track and pay off their debts. It helps users prioritize their payments and accelerate their debt repayment journey. 4. Savings Goal Worksheet: This worksheet helps users set and track their financial goals, such as saving for a down payment, a vacation, or a big purchase. It provides a roadmap to achieve these goals by breaking them down into smaller, manageable steps.

How to complete personal budget worksheet pdf

Completing a personal budget worksheet PDF is a straightforward process that can greatly benefit your financial stability. Follow these steps to get started: 1. Gather Financial Information: Collect all relevant financial documents, such as bank statements, pay stubs, and bills. This will ensure you have accurate and up-to-date information. 2. Track Income: Enter all sources of income, including wages, freelancing gigs, investment returns, and any other money you receive regularly. 3. Record Expenses: Categorize and record all your expenses, such as rent/mortgage, groceries, utilities, transportation, entertainment, and debt payments. Be thorough and include all expenses, no matter how small. 4. Calculate Savings: Deduct your expenses from your income to determine how much you can save each month. Set a realistic savings goal and strive to achieve it. 5. Review and Adjust: Regularly review your budget and make adjustments as needed. Track your progress towards your financial goals and make changes to ensure you are staying on track.

By following these steps and using a personal budget worksheet PDF, you can take control of your finances and make more informed decisions about your money. Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.