Personal Financial Statement Definition

What is personal financial statement definition?

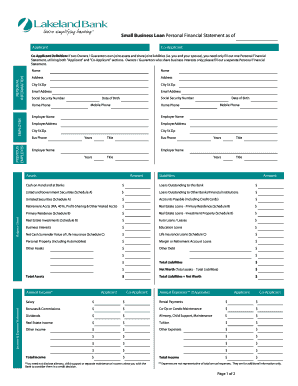

A personal financial statement is a document that provides a snapshot of an individual's financial situation. It includes information about their income, expenses, assets, and liabilities. It helps individuals assess their financial health, plan for the future, and make informed financial decisions.

What are the types of personal financial statement definition?

There are several types of personal financial statements that individuals can use depending on their specific needs. These include: 1. Personal Balance Sheet: This statement provides a detailed overview of an individual's assets, liabilities, and net worth. 2. Income Statement: This statement outlines an individual's income and expenses, helping them analyze their spending habits and financial performance. 3. Cash Flow Statement: This statement tracks an individual's cash inflows and outflows, providing insights into their sources of income and expenditure patterns. 4. Budget Statement: This statement helps individuals create a financial plan by outlining their expected income and expenses over a specific time period.

How to complete personal financial statement definition

Completing a personal financial statement can seem overwhelming, but with the right approach, it can be a straightforward process. Here are the steps to complete a personal financial statement: 1. Gather your financial documents: Collect all relevant documents such as bank statements, investment records, loan statements, and credit card bills. 2. List your assets: Record all your assets, including cash, savings, investments, real estate, and vehicles. 3. Calculate your liabilities: Note down all your debts, such as mortgages, student loans, credit card debts, and personal loans. 4. Determine your income: State your sources of income, including salaries, dividends, rental income, and any other sources. 5. Document your expenses: Detail your recurring expenses, such as housing costs, groceries, transportation, utilities, and entertainment. 6. Calculate your net worth: Subtract your liabilities from your assets to determine your net worth. 7. Review and update regularly: It's essential to review and update your personal financial statement regularly to reflect any changes in your financial situation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.